05 Sept. 2022, Atty Ronald Recidoro, Executive Director at Chamber of Mines of the Philippines at the PMEA Monthly Membership Meeting, Manila Elks Club, Makati City (Photo by Marcelle P. Villegas for Philippine Resources Journal)

"We see very clearly that the provisions will be deadly for the mining industry. If 5% royalty across the board, and a 50%-50% government share, plus a 10% excise tax on raw exports will kill the industry, it will not be competitive and the revenues they are forecasting of something like 38 billion will not happen."

(Atty Ronald Recidoro on the new Unnumbered Bill)

Atty Ronald Recidoro, Executive Director at Chamber of Mines of the Philippines, described the new Unnumbered Bill in mining as “Killing the goose to get to the golden eggs”.

He expressed his sentiments and professional insights regarding the new mining bill during the recent Philippine Mining & Exploration Association (PMEA) Monthly Membership Meeting last 5th of September. Atty Recidoro was one of the guest speakers for this meeting.

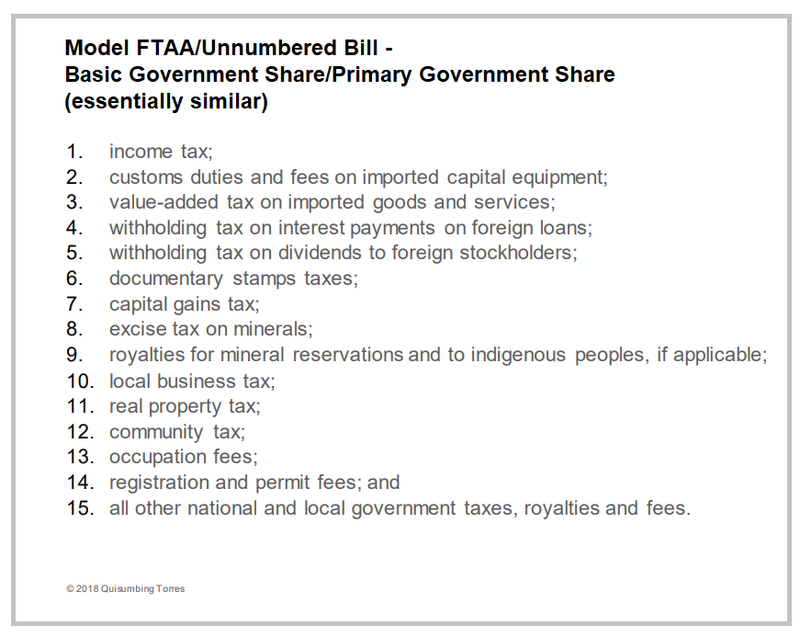

One of the speakers for the evening was Atty Dennis Quintero, who gave a presentation on the Legal Updates for the industry. Atty Quintero is the Head of Energy, Mining & Infrastructure at Quisumbing Torres. He was joined by his colleague, Mr Kristian Angelo Palmares in explaining the Mining Bills Update, particularly about the Unnumbered Bill. This was followed by the reactions and comments by Atty Recidoro.

"An Act Establishing the Fiscal Regime for Mining Industry"

Atty Quintero explained that the Unnumbered Bill is a substitute to House Bills 373, 2014, 2246 and 3888. Its approval is currently pending with the Committee on Ways and Means.

Here are key points about the bill, as summarised by Atty Quintero:

~ At the beginning of the 19th Congress, House Bills 373, 2014, 2246, and 3888 were filed and subsequently referred to the Committee on Ways and Means. Having similar subject matters, these were consolidated into the Unnumbered Substitute Bill.

~ The bill seeks to impose margin-based royalties on income from large-scale metallic mining operations at a rate of 5% of the market value of the gross output whether inside or outside mineral reservations. It seeks to cover both Mineral Production Sharing Agreements and Financial or Technical Assistance Agreements.

~ Mining contractors are also required to pay minimum government share when the primary government share is less than 60% of the net mining revenue. The minimum government share shall be the difference between 60% of net mining revenue and the primary government share during the calendar year. In this regard, “primary government share” shall consist of all direct taxes, royalties, fees, and related payments required by existing laws, rules, and regulations to be paid by the contractor.

~ The bill likewise imposes a 10% tax on the market value of raw ore exports.

~ Furthermore, it treats each mining operation covered by a mineral agreement or FTAA as a separate taxable entity.

~ The bill also provides that the National Government shall have a share of 60% of the gross collection derived by any government agency or instrumentality from excise taxes on mineral products, royalties, and such other taxes.

~ Note: Before they were consolidated to the Unnumbered Substitute Bill on 24 August 2022, HB 373, 2014, and 2246 were filed on the following dates:

• HB 373 – 30 June 2022

• HB 2014 – 14 July 2022

• HB 2246 – 22 July 2022

• HB 3888 – 22 August 2022

Effects of the Proposed Bill on the Mining Industry

Atty Recidoro said, "We see very clearly that the provisions will be deadly for the mining industry. If 5% royalty across the board, and a 50%-50% government share, plus a 10% excise tax on raw exports will kill the industry, it will not be competitive and the revenues they are forecasting of something like 38 billion will not happen."

He also emphasised the unusually rushed passage of the house bill. “If you were in attendance at the meeting last Aug. 24, you will see that the four versions of the bill contained very different provisions. Now they provided four very different tax rates and had differing fiscal regimes. So in cases like these, the usual procedure should have been for the Committee to refer the bill plus the DOF proposal. The DOF proposal isn't even actually a bill. It was just a written proposal from the DOF. It was not yet filed as a bill. Some undersecretary from the DOF just went to the Committee at that day and gave the Committee a copy of the proposal.”

“So given these four versions plus the DOF proposal, the usual process should have been for the Committee to create a technical working group, and then try to hash out the differences and come out with a common substitute bill. This did not happen clearly. This was not done. The Committee voted instead the DOF proposal in its entirety.”

He said that the Committee threw away House Bills 373, 2014, 2246, and 3888. “They just chose to adopt the DOF version which we have not yet seen. Nobody has seen it at that time. So it is very strange from a procedural and substantive due process perspective.”

Furthermore, he clarified that they find this unusual because of the circumstances surrounding the mining fiscal regime. “The Marcos Administration has come up very strongly for mining. They have identified mining as key driver for this administration and they are seriously wanting to push it forward.”

Killing the goose that lays the golden eggs

Additionally, Atty Recidoro pointed out that the 5% royalty for all large-scale metallic mines, regardless of whether they are within mineral reservations or outside of mineral reservation, together with a 60%-40% sharing is exceptionally heavy. “If passed, that regime would make the Philippines mining fiscal regime uncompetitive versus other mineral-rich countries such as Peru, Chile, and South Africa.”

“In a recent study we did at the Chamber of Mines to model the average effective tax rate (AETR) of the DOF proposal, we found that the proposal would amount to something like 71% average effective tax rate, much higher than the AETR for the current FTAA which we beg at around 63.5%. AETR is essentially government's tax take.”

“So the proposal with net government 71% AETR over life of mine…that is exceptionally heavy! It will be higher than the following countries: Peru at 51.9%, Queensland, Australia at 51%, Canada at 50.4%, and South Africa. More importantly, it would bring up the AETR for existing MPSAs from the current 45.3% to 71%. So we were alarmed. This is an exceptionally heavy imposition which will kill the industry.”

In response to this, Atty Recidoro said that the Chamber has been exerting efforts to communicate this fact to the Committee Chair, the House leadership, the Senate, and even the Executive Department. The goal is to make them all aware that the DOF proposal, if passed, will not accomplish the objectives of the bill which is to increase revenues from the extractive sector, to fund government programs in disaster risk management, environmental rehabilitation, and economic recovery.

“If they push this bill, there will be no increased revenues from mining. This is essentially [the] government killing the goose to get at the golden eggs. It's just going to kill the goose. It would lead to the non-starting of three large-scale mining projects that they are already in the development stage which we envision will bring in an additional 1.2% to Philippine GDP once they start operating.”

He further noted that this would lead to closure of several large marginal mines, which would then lead to large-scale unemployment in the areas where these mines are operating.

“We have also issued a strongly-worded statement denouncing the substitute bill passed by the Committee essentially saying that this will not achieve the revenues it is targeting and will only underline the instability of the country's mining policy, making the country more uncompetitive to foreign investment.”

“Fortunately, it seems that our efforts, led by my chair, Atty Mike Toledo, and Gerry Brimo have borne fruit. Just this morning, we received word that the house bill which has already been approved by the Committee has been recalled.”

He said that the Committee has recalled and has re-opened discussions on it which was scheduled last 7th of September, to allow stakeholders to voice their positions on the bill.

Atty Recidoro said that the Chamber intends to give a presentation that will emphasize the negative impact of the DOF proposal and ask that the Committee should consider the passage of House Bill 373 instead.

House Bill 373 – A More Equitable Bill

“House bill 373 is not a new bill. It was previously passed in the 18th Congress as House Bill 6135 also by Salceda. This House Bill 373 will seek to establish a new mining royalty scheme over and above the existing excise tax under the NIRC.”

“However, it really imposed a tax not on gross output but rather it is conditioned on companies achieving a minimum margin. And as you achieve a larger margin, your tax rate will also increase but this tax will be imposed on income, and not on gross output, which means that you will only be taxed only when you’re making money.”

“If you have no margin then you have no additional tax which we have always insisted. This is the more equitable, more progressive way of doing it.”

Atty Recidoro said that the Philippines is probably the only mining country in the world that relies heavily on gross-based royalties and excise tax, which makes the tax rate heavy.

“The bill also proposes the establishment of a natural resource trust fund to be taken from government shares which will then be distributed to LGUs, to support educational programs, disaster risk management, and rehabilitation of abandoned mines. For as long as it is taken from government shares, I don’t think we have a problem. In fact, we will support that whole-heartedly. The Chamber of Mines has publicly given its support to the passage of House Bill 373 and we believe that if passed, it can serve as a competent financial baseline for re-negotiations, to guide DENR, MGB and DOF when we re-negotiate new mineral agreements.”