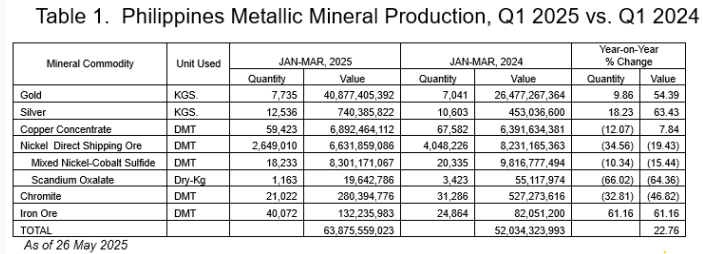

The value of metallic mineral production began the year on a strong note, experiencing a 22.76 percent increase, or PhP11.84 billion, rising from PhP52.03 billion in Q1 2024 to PhP63.88 billion in Q1 2025. This growth was driven by the bullish prices of gold, silver, and copper, alongside a rise in gold and silver production.

According to data from the Bangko Sentral ng Pilipinas, gold prices reached an unprecedented level of US$2,858.27 per troy ounce, up from US$2,070.05 per troy ounce the previous year—a significant increase of 38.08 percent, or US$788.22. Silver also saw substantial gains, with prices climbing 39.29 percent from US$22.85 per troy ounce to US$31.83 per troy ounce year-on-year. Copper prices rose by 10.89 percent, increasing from US$3.83 per pound to US$4.24 per pound year-on-year. In contrast, nickel prices fell slightly from US$7.53 per pound to US$7.08 per pound, mainly due to a supply glut caused by decreased demand in China stemming from geopolitical tensions and tariff disputes, combined with increased production in Indonesia. It is important to note that China accounted for 66 percent of global nickel consumption in 2024, down from 80 percent in 2023. Nickel is primarily used in stainless steel production, battery manufacturing, and renewable energy technologies

Regarding contributions to total metallic mineral production value, gold led with a substantial share of 64 percent, amounting to PhP40.88 billion. The combined output of nickel ore and other nickel byproducts secured second place, accounting for 23.41 percent, or approximately PhP14.95 billion. Copper ranked third with a share of 10.79 percent, corresponding to PhP6.89 billion. Lastly, the total value of silver, chromite, and iron ore accounted for roughly 1.81 percent, or PhP1.15 billion.

In terms of gold production, both the total volume and value rose significantly by about 10 percent and 54 percent, respectively, up by 695 kilograms and PhP14.40 billion. This increases from 7,041 kilograms with an estimated value of PhP26.48 billion to 7,736 kilograms with an estimated value of PhP40.88 billion year-on-year. The notable increase in value, PhP14.40 billion, can be attributed to the strong gold prices, which grew by US$788.22 per troy ounce compared to previous years. The outlook for gold in the short to medium term (2025-2026) is favorable, as demand for the metal remains high due to global economic uncertainties. Gold, one of history's most enduring commodities, has long been regarded as a safe-haven asset that helps protect investors against inflation and economic downturns.

The Philippines Gold Processing and Refining Corporation in Masbate led gold production with 1,442 kilograms, valued at PhP7.69 billion. This was followed by FCF Minerals, which produced 653 kilograms, and OceanaGold Philippines Inc. (OGPI), with 640 kilograms. Apex Mining Company Inc. ranked fourth with 628 kilograms produced.

The Bangko Sentral ng Pilipinas (BSP) also recorded significant purchases from its buying stations in Quezon City, Baguio City, Davao City, Naga City, and Butuan. During the review period, BSP's purchases increased from 1,906 kilograms to 2,953 kilograms, marking a 55 percent rise. These figures include purchases from Benguet Corporation (BC) from the Acupan Contract Mining Project and 25 percent of OGPI's gold dore production during the quarter. BC sells its entire gold output to the BSP.

In accordance with Chapter III, Section 13.c.8 of DAO No. 2015-03 (Revised IRR of RA No. 7076), which is commonly referred to as the "People’s Small-Scale Mining Act of 1991," small-scale mining contractors are mandated to sell their production output either to the BSP or through its authorized buying stations or agents in the case of gold production. Consequently, the BSP is considering the establishment of additional buying stations to enhance convenience and accessibility for registered small-scale miners and accredited traders.

It is noteworthy that the enactment of Republic Act No. 11256, known as An Act to Strengthen the Country’s Gross International Reserves (GIR), which amends Sections 32 and 151 of the National Internal Revenue Code, as amended and for Other Purposes on 29 March 2019 and the Revenue Regulations No. 4-2020 (Implementing the Provisions of RA No. 11256) which was signed on 29 January 2020, has encouraged small-scale miners and traders to resume selling their gold to the BSP.

The salient features of these regulations include tax exemptions for specific transactions:

- Income derived from the following sale of gold is excluded in the gross income and shall be exempt from income tax, and consequently from withholding taxes: (1) The sale of gold to the BSP by registered SSMs and accredited traders; and (2) The sale of gold by registered SSMs to accredited traders for eventual sale to BSP.

- Excise tax will not be imposed on: (1) The sale of gold to the BSP by registered SSMs and accredited traders; and (2) The sale of gold by registered SSMs to accredited traders for subsequent sale to the BSP.

On the other hand, nickel ore production volume and value declined significantly, dropping from 4,048,226 dry metric tons valued at PHP 8.23 billion to 2,649,010 dry metric tons valued at PHP 6.63 billion year-on-year. This represents a substantial decrease of 1,399,216 dry metric tons and PHP 1.60 billion. The average nickel price during the first quarter fell by 6.05 percent, decreasing from US$7.53 per pound to US$7.08 per pound year-over-year.

Of the 37 operating nickel mines, only 14 reported production, with Rio Tuba Nickel Mining Corporation in Palawan leading at 666,032 dry metric tons, followed by LNL Archipelago Minerals Inc. with 388,394 dry metric tons, and Zambales Diversified Metals Corporation with 323,776 dry metric tons. Twentythree nickel mines reported no production, primarily due to weather conditions, off-season limitations, care and maintenance programs, and low nickel prices. In the Caraga region, known as the nickel capital of the country, significant rainfall usually occurs during the first and fourth quarters of the year, impacting mining operations. Nickel mining, performed through surface mining techniques, is especially susceptible to wet weather conditions.

During this period, the Coral Bay Nickel Corporation (CBNC) and Taganito HPAL Nickel Corporation (THPAL) produced a total of 18,233 dry metric tons of Nickel-Cobalt Mixed Sulfide (MS), valued at approximately PhP8.30 billion. This output represented a decrease from 20,335 dry metric tons, which had an estimated value of PhP9.82 billion, marking declines of 10 percent in volume and 15 percent in value. The review period saw a significant drop in the ore delivered by RTNMC and Taganito to CBNC and THPAL, respectively and this was attributed to excessive rainfall that rendered many mining areas inaccessible and hindered planned developments of new mining sites. As a result, production activities during the quarter faced severe constraints.

CBNC and THPAL are the only hydrometallurgical nickel processing plants in the country, commissioned in 2005 and 2013, respectively. Both utilize High-Pressure Acid Leaching (HPAL) technology to convert low-grade nickel lateritic ores into MS, an intermediate product with high commercial value. Once further refined, MS can be used as valuable components in special steels, as well as in electric and battery materials. The Philippine government is actively encouraging investments, to enhance downstream mining activities and create processing facilities that will add value to our mined minerals. In addition to MS, THPAL also produced scandium oxalate and chromite. Approximately 1,163 dry metric tons of scandium oxalate were produced, with an estimated value of PhP 19.64 million.

Copper production volume experienced a 12 percent decline, dropping from 67,582 dry metric tons to 59,423 dry metric tons year-on-year. However, the estimated value of copper production increased by almost 8 percent, rising from PhP6.39 billion to PhP6.89 billion. This increase in value was attributed to better copper prices during the period, which rose from US$3.83 per pound to US$4.24 per pound year-on-year. The country has only three copper producers: Carmen Copper Corporation (CCC) in Cebu, OceanaGold Philippines Inc. (OGPI) in Nueva Vizcaya, and Philex Mining Corporation (PMC) in Benguet. In terms of production distribution, CCC dominated with 54 percent of the total output, amounting to 32,299.

The production volume and value of silver grew impressively, increasing by 18 percent and 63 percent, respectively. Production rose from 10,603 kilograms with an estimated value of PhP453.04 million to 12,536 kilograms valued at PhP740.38 million. The improved price, rising from US$22.85 per troy ounce to US$31.83 per troy ounce year-on-year, represented an almost US$9.00 increase, which made a significant difference. The Balabag Gold-Silver Project of TVI Resource Development (Phils) Inc. in Zamboanga del Sur led silver production, accounting for nearly 44 percent with 5,531 kilograms valued at PhP331.38 million. This was followed by Apex Maco Operation of Apex Mining Corporation, which produced 3,094 kilograms valued at PhP181.58 million, and the Didipio Copper-Gold Project of OGPI, contributing 1,448 kilograms valued at PhP87.24 million.

Chromite production had a slow start, with a volume of 31,286 dry metric tons valued at approximately PhP527.27 million, decreasing to 21,022 dry metric tons valued at around PhP 280.39 million year-on-year. This represents a shortfall of almost 33 percent in volume and 47 percent in value. Only two companies, Techiron Resources, Inc. and Taganito HPAL Nickel Corporation, reported production, while Krominco, Inc. in Caraga remained in care and maintenance status.

Iron ore production took a leap, with 61 percent growth both in volume and value from 24,864 dry metric tons valued at PhP82.05 million to 40,072 dry metric tons valued at PhP132.24 million. Only Ore Asia Mining & Development Corporation in Bulacan reported production, while MacArthur Iron Projects Corporation and Atro Mining Vitali Iron Inc. reported zero production.

In the first quarter of 2025, the estimated excise tax collected was approximately PhP1.33 billion. The breakdown of this estimated collection by type of mine is as follows: PhP658.86 million (49.68%) from gold mines, PhP330.04 million (24.88%) from copper mines, PhP 324.71 million (24.48%) from nickel mines, PhP7.36 million (0.56%) from chromite mines, and PhP5.30 million (0.40%) from iron mines.

Additionally, the estimated revenue obtained from royalties derived from the development and utilization of mineral resources within mineral reservation areas amounted to about PhP145.11 million in Q1 2025. Currently, there are 21 mining projects located within these reservation areas, comprising twenty nickel mining projects and one chromite mining project.

As of February 2025, approximately 2.53 percent of the Philippines' total land area, which covers 30 million hectares, is covered by mining tenements. This amounts to about 758,864.23 hectares. According to the Mines and Geosciences Bureau (MGB), nine million hectares have been identified as having high mineral potential. However, only about 8.43 percent of these highly mineralized areas are currently covered by mining tenements. It's important to note that this estimate does not include permits issued by local governments, such as quarry permits and permits for industrial and commercial sand and gravel.

On a local scale, the Philippine Statistics Authority reports that the country's Gross Domestic Product (GDP) grew by 5.4% at constant 2018 prices in the first quarter of 2025. Within the Industry Sector, which encompasses Mining and Quarrying, year-on-year growth was recorded at 2.0 percent, an improvement from the 0.5 percent growth noted in the same quarter of 2024. Among the metals, the mining of gold and other precious metals saw growth, whereas the mining of nickel ore and copper ores experienced declines.

By and large, the progress of the country's minerals industry will be shaped by a combination of economic, political, and global factors:

- Regulatory and Policy Environment: Supportive government initiatives, such as incentive programs, streamlined regulations, efficient permitting processes, tax breaks, and necessary reforms.

- Geopolitical and Global Trends: Demand from major trading partners, disruptions in metal supply chains due to a decline in global manufacturing and industrial activities, as well as global tensions and trade restrictions.

- Economic Conditions: Fluctuations in metal and fuel prices, infrastructure development, and the overall investment climate.