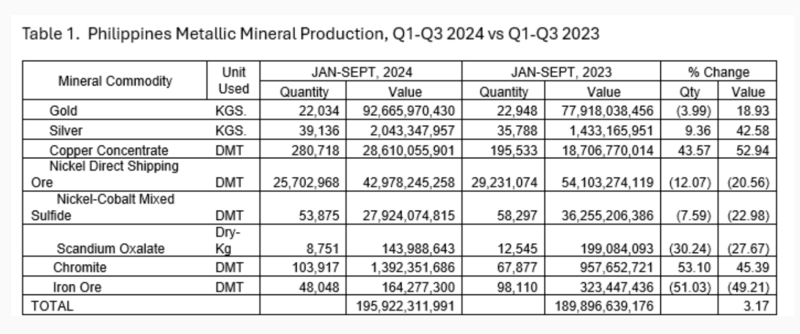

During the first three quarters of 2024, the value of metallic mineral production increased by 3.17%. This is equivalent to PHP6.02 billion rise in production, from PHP189.90 billion to PHP195.92 billion year-on-year.

Precious metals, particularly gold and silver, have experienced a significant surge in value, driven by growing investor interest amidst rising inflation. Recent data reveals an increase in the prices of these commodities, reflecting a broader trend of investors turning to gold against economic uncertainty.

According to the latest price bulletin of Banco Sentral ng Pilipinas (BSP), gold has an of $361.17, representing an impressive 18.69% jump in value. Silver has a remarkable rise with a $3.46 increase, translating to a 14.69% gain.

Analysts give credit to this surge directly to heightened inflation rates, which are prompting investors to seek safe-haven assets like gold to protect their wealth. Gold is traditionally considered as a store of value that maintains its purchasing power during periods of economic instability and currency devaluation. As inflation erodes the value of traditional currencies, the demand for gold increases as well.

The performance of gold in 2024 has been impressive. The price of gold has consistently remained above the $2,000 mark, showcasing its resilience and appeal. In September, the price of gold reached a peak of $2,565.25 per troy ounce, highlighting the strong upward trend.

Market expectations lead towards continued price increases for precious metals throughout the remainder of the year. While inflation concerns persist and global economic uncertainty remains, the demand for gold and silver is anticipated to remain strong.

Meanwhile, silver prices are expected to remain strong, driven by industrial demand, particularly in the solar sector. The price of silver improved from $23.55 per troy ounce to $27.01 per troy ounce. Additionally, copper prices rose to $4.07 per pound, up from $3.90 per pound year-on-year. In contrast, nickel prices have significantly declined. According to the London Metal Exchange, nickel prices fell by 25.43%, decreasing from $10.39 per pound to $7.75 per pound year-on-year.

This surge in precious metal prices underscores the importance of diversifying investment portfolios and considering alternative assets like gold and silver, particularly during periods of economic volatility. Investors seeking to mitigate the impact of inflation may find these precious metals an attractive option to preserve and potentially grow their wealth.

In the metal market, silver and copper enjoying price appreciation while nickel experiences a significant downturn.

Silver has great potential due to rise in industrial demand particularly in the solar energy sector, which relies heavily on silver in photovoltaic cells. This heightened demand has pushed the price of silver upward, rising from $23.55 per troy ounce to a current level of $27.01 per troy ounce.

Copper is also performing well in the price trends with a price increase to $4.07 per pound. This is a notable jump from $3.90 per pound compared to the same period last year. This increase is due to the current demand in copper from the construction industry, electronics, and infrastructure development.

Nickel on the other hand is experiencing a significant downturn with its price decline. Data from the London Metal Exchange (LME) reports a decrease of 25.43% in nickel prices year-on-year. This translates to a fall from $10.39 per pound to $7.75 per pound.

Last year, gold was the leading commodity in terms of total contributions. It had a 47.30% of the total value, which amounts to PhP92.67 billion.

Nickel ore and its by-products, including nickel-cobalt mixed sulfide (NCMS) and scandium oxalate, together represented 36.26%, or PhP71.05 billion.

Copper ranked third, contributing 14.60% or PhP28.61 billion. The combined value of silver, chromite, and iron ore was PhP3.60 billion, which represents approximately 1.84% of the overall contributions.

From MGB’s year-end review, the performance of gold remained robust, despite a 4% decrease in production volume, which fell from 22,948 kilograms to 22,034 kilograms. However, the production value increased from PhP77.92 billion to PhP92.66 billion, representing an increase of PhP14.75 billion or 18.93%.

Bicol Region is the prime gold producer with 20.40% of the total production, yielding 4,495 kilograms. This is due to the remarkable output of Philippine Gold Processing and Refining Corporation. Region II or the Cagayan Valley Region ranks as second to this with a contribution of 20.02% or 4,268 kilograms, which is the combined output of FCF Minerals and OceanaGold (Phils.) Inc. Next in place is Region XI or Davao Region with an output of 2,085 kilograms.

The Cordillera Administrative Region ranks on fourth place with a production of 1,626 kilograms, while the Caraga Region is on the fifth rank with a production of 1,553 kilograms.

MGB reported that the production loop was completed by Region VII, represented by Carmen Copper Corporation, with an output of 1,021 kilograms; and Region IX, represented by TVI Resources Development (Philippines) Inc., with an output of 904 kilograms.

Johson Mining Corporation and Tribal Mining Corporation reported no production during this period.

The average price of gold for over the nine-month period it noteworthy, increasing from US$1,932.07 per troy ounce in 2023 to US$2,293.24 in 2024, year-on-year.

Gold remains a stable commodity for investment even during economic downturns. Silver production in terms of volume and value experienced substantial growth, increasing by 9% and 43%, respectively.

This increase brought the production totals from 35,788 kilograms, valued at approximately PhP1.43 billion, to 39,136 kilograms, with a value of around PhP2.05 billion year-on-year.

The overall increase in volume was due to the impressive 39% rise in output from TVI Resources Development (Philippines) Inc. at its Balabag Gold-Silver Project in Zamboanga del Sur. Their production increased from 13,973 kilograms, valued at PhP569.28 million, to 19,430 kilograms, with an estimated value of about PhP1,007.45 million year-on-year.

Second to this is Apex Mining Company Inc. which produced 7,426 kilograms, valued at PhP378.45 million.

The Philippine Gold Processing & Refining Corporation reported production of 4,387 kilograms, while OGPI produced 3,488 kilograms.

Copper production showed significant growth, with volumes increasing by 44% and overall value rising by 53%.

Copper production increased from 195,533 kilograms, valued at approximately PHP 18.71 billion, to 280,718 dry metric tons, with an estimated value of PHP 28.61 billion, year-on-year.

The re-entry of Carmen Copper Corporation's (CCC) Toledo Copper Operation in the Lutopan Mining Area contributed greatly to the growth in copper production, with a production of 79,914 dry metric tons. Additionally, CCC’s Carmen Mining Area, had an 11% increase in production volume, amounting to 12,638 dry metric tons.

On the other hand, Philex Mining Corporation had a decline in production at 8%, while OGPI also reported production decline at 9%.

Chromite has been doing well in terms of production. It had increased for both volume and value, rising from 67,877 dry metric tons with an estimated production value of PHP 957.65 million to 103,917 dry metric tons valued at approximately PHP 1,392.35 million year-on-year. Techiron Resources Inc. made this remarkable production increase, from 10,508 dry metric tons to 55,327 dry metric tons year-on-year.

Second to this is Taganito HPAL Nickel Corporation, which produced 48,590 dry metric tons. (Taganito’s chromite production is a by-product of its NCMS output.)

For nickel, Due to oversupply and reduced demand from China, nickel ore and its by-products, NCMS and scandium oxalate, experienced a decline in overall performance. Nickel value fell from PhP90.56 billion to PhP71.05 billion year-on-year, representing a decrease of PhP19.51 billion.

Nickel production volume and value of nickel ore decreased by 12.07% and 20.56%, respectively. This decline went from 29,231,074 dry metric tons, valued at approximately PhP54.10 billion, to 25,702,968 dry metric tons, with an estimated value of PhP42.98 billion.

Caraga Region, the nickel hub of the Philippines, contributed 62.24% of the total, amounting to 15,988,700 dry metric tons.

Next in the rank is MIMAROPA with approximately 18%, contributing 4,626,941 dry metric tons.

Regions VIII and III contributed about 11.08% (2,848,283 dry metric tons) and 5.62% (1,445,621 dry metric tons), respectively.

Lastly, Regions XI and II added 509,455 dry metric tons and 273,968 dry metric tons, respectively, to the overall production.

For scandium oxalate (by-product of the Taganito THPAL operation), the production volume and value totaled 8,751 dry kilograms. This represents a 30% decrease from the previous year's total of 12,545 dry kilograms. Similarly, the production volume of NCMS fell by 8%, declining from 58,297 dry metric tons to 53,875 dry metric tons year-on-year.

There was also a decline in the production value by 23%, from PhP36.26 billion to PhP27.92 billion. This was attributed to maintenance shutdowns at the producing plants. The total value of NCMS includes an estimated value based on its cobalt content.

Bulacan’s Ore Asia Mining & Development Corporation is the only producer of iron in the Philippines. They had a decline in both production volume and value. There has been a 51% reduction in production volume, dropping from 98,110 dry metric tons to 48,048 dry metric tons, and a 49% decrease in value, falling from approximately PhP323.48 million to PhP164.28 million compared to the previous year.

Leyte Ironsand Project, operated by MacArthur Iron Projects Corp and Atro Mining Vitali Iron Inc., reported no production during the same period. The project is located in the towns of Dulag, Mayorga, MacArthur, Javier, and Abuyog.

During the first three quarters of 2024, it is estimated that the excise tax collection will reach approximately PhP5.11 billion. Meanwhile, the expected royalties from the development and utilization of mineral resources within the mineral reservation areas are around PhP2.73 billion.

Currently, there are 21 mining projects located in these mineral reservation areas, including 20 nickel mining projects and one chromite mining project.