The Philippine Nickel Industry Association (PNIA), the country’s largest group of nickel mining companies, has voiced strong concerns regarding the renewed suggestion to impose an ore export ban as part of the mining fiscal regime reforms, highlighting that such a policy may not address the real challenges faced by the industry in developing value-added processing (VAP) in the Philippines.

“We support the aspirations of the government for a more developed nickel industry; however, it is our position that an export ban is not a timely policy at the moment,” said Atty. Dante R. Bravo, PNIA president, urging that the focus be on creating the right environment to attract the right investments and enable VAP development.

Atty. Bravo, along with his colleagues at PNIA, expressed their insights during a PNIA Media Roundtable discussion last Feb. 11 at Romulo Café in Quezon City.

He further said, “A proposal like the ore export ban is appealing, however if implemented at this time, it overlooks the regulatory and business challenges that make value-added processing in the Philippines difficult to implement.”

The proposal aims to encourage VAP by banning the export of raw nickel ores, but the difficulties in establishing and sustaining VAP facilities in the Philippines have to be addressed.

“Without holistic government support, addressing inconsistent policies, and regulatory burdens, forcing value-added processing will lead to mine closures and job losses,” said Atty. Bravo. “The government needs to create a more conducive business environment before pushing for policies that might disrupt the industry’s progress.”

Also present in the discussion is Mr. Martin Antonio G. Zamora, PNIA Board Director. and Ms. Charmaine Olea-Capili, Executive Director of PNIA.

Mr. Zamora, PNIA Board Director and President of Nickel Asia Corporation, said, "Whether the ban is imposed in 5 to 10 years, we believe it should not be there at all. There are so many things that the country needs to do to promote value-added processing (VAP) -- we have to work on the fundamentals first such as east of doing business.”

“One part of that is streamlining the policies between national and local governments.”

“We are disagreeing [to the ban] but we are not disagreeable. PNIA fully supports the ambition of the government to promote VAP, but we sincerely believe that implementing the ban will not push forward the goal,” he said.

During the media event, PNIA’s presentation report "Driving Growth: PNIA’s 2025 Industry Outlook for the Philippine Nickel Sector" clarified how the ore export ban issue will affect the nickel industry. Here are some key points:

1. PNIA urges reconsideration of ore export ban, stressing that the Philippines must first create a competitive environment to attract investments in value-added processing (VAP) before implementing restrictive policies.

2. Implementing a ban on ore exports will further add to uncertainty from potential investors, along with ease of doing business, long permitting processes, and harmonization of national and local policies.

3. Calls for swift action to seize global nickel opportunities, highlighting that the country risks falling behind as competitors like Indonesia, Brazil, and Australia ramp up production and attract foreign investments.

4. Warns of geopolitical and market risks, cautioning that an export ban could drive buyers to alternative suppliers and undermine the Philippines' competitiveness amid evolving trade policies and shifting demand for nickel.

The Need to Scale Up Quickly to Capture Opportunities from Nickel

Years ago, before Indonesia started implementing an ore export ban, they first prepared a conducive investment climate for value-added processing.

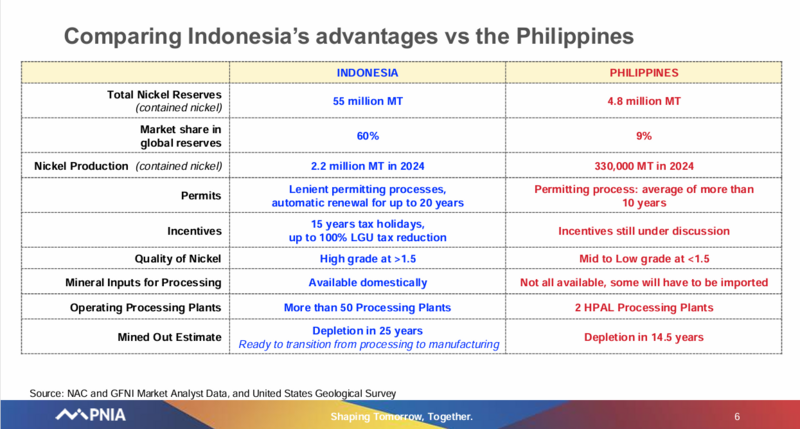

PNIA pointed out that Indonesia has several advantages that the Philippines lacks, including policy implementation, infrastructure, and strong government support. More importantly, the ore ban was only implemented after the country had secured a substantial number of investors committed to its mining industry growth.

“Indonesia has been able to attract foreign investments, build infrastructure, and offer very attractive fiscal incentives that have allowed it to quickly scale up processing capacity driven by strong government support,” said Atty. Bravo.

“From our experience, the Philippines lacks the same environment for investors, for instance, it takes over ten (10) years just to approve mining permits, which could force investors to look for a more attractive regulatory environment in other countries where they can get attractive return on investments.”

“Value-added processing requires more than just government support and building facilities; first and foremost, we need to conduct a strategic and in-depth mapping of resources to identify quality of nickel and quantity of nickel as not all ore is good for value-added processing. Additionally, we have to begin upskilling our mining engineers to prepare them for processing activities. Without addressing these key issues, imposing an ore export ban at this time would slow progress and risk industry failure.”

Geopolitical and Market Shifts

The complexity of the proposed ore export ban is compounded by evolving geopolitical dynamics and persistent trade tensions.

“The growing uncertainty in global trade, particularly regarding potential trade tariffs, places the competitiveness of Philippine nickel exports at risk,” said Atty. Bravo. “It’s important that we maintain the competitiveness of the industry, particularly as geopolitical factors continue to evolve.”

This highlights the need for a carefully considered approach to ensure the future of the mining sector.

He also mentioned that in comparison to countries like New Caledonia, Brazil, and Australia, these countries are increasing their nickel production, presenting additional competitive challenges. “If the Philippines were to implement an ore export ban, countries like China may turn to other nickel suppliers,” Atty. Bravo explained. “As these markets grow more competitive, we could lose valuable buyers and miss out on key export opportunities.”

Atty. Bravo also emphasized that the timing of the ore export ban should be carefully reconsidered, particularly as global nickel demand continues to evolve rapidly.

“With rapid development in battery technologies, shifts in China’s stainless steel production, and other changes in the global supply chain, now is not the right moment for an ore export ban,” he said. “This policy may undermine our competitiveness and fail to adequately account for the fast-moving dynamics of supply and demand. Instead of imposing restrictions prematurely, the focus should be on strengthening the country’s investment climate to ensure the long- term sustainability of the sector.”

Industry Outlook for 2025

In 2025, the global nickel market is anticipated to be dynamic. According to PNIA Market Analysts, global nickel production is projected to increase by 3.8%. However, consumption is projected to grow at a faster rate of 5%, reaching 3.514 million tons, largely fueled by demand from the stainless steel and renewable energy sectors.

“While global demand remains strong, the oversupply from Indonesia and shifts in technology will continue to put downward pressure on prices,” said Atty. Bravo.

Nickel prices, recently hitting a four-year low, are forecast to average $16,750 per ton in 2025, with potential spikes to $20,000 early in the year. “Price fluctuations due to oversupply from Indonesia and changing demand patterns, such as the growing preference for lower-nickel batteries, will impact market stability,” said Bravo.

Despite the challenges, the Philippines remains a key player in the global nickel supply. The Department of Trade and Industry reports foreign investments in the mining and quarrying industry at PHP 79.19 billion between July 2022 and December 2024, with key investments from China, Australia, and Japan.

PNIA continues to work with government partners to help the mining sector grow sustainably. Atty. Bravo concluded, “We must work with the government to create policies that encourage investment in both mining and value-added processing, ensuring that the benefits of the nickel industry are fully realized for all stakeholders.”

ABOUT PNIA

The Philippine Nickel Industry Association, Inc. (PNIA) is a non-stock, non-profit association registered with the Securities and Exchange Commission. Established in 2012, PNIA serves as the unified voice of the nickel industry, advocating for its role as a globally competitive and responsible driver of inclusive and sustainable economic growth in the Philippines. Through its Nickel Initiative, PNIA promotes collaboration with the government and various stakeholders to enhance the competitiveness of the nickel industry, anchored in responsible mining and sustainable development.