The Philippine metallic mining industry posted double-digit growth in the first half of 2025, powered by record-breaking gold prices that more than offset weaker nickel markets.

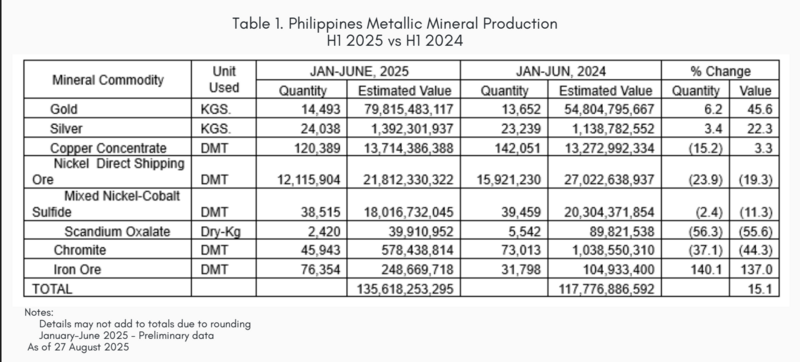

Data from the Mines and Geosciences Bureau (MGB) showed that the sector’s total value rose 15.1 percent to ₱135.62 billion from ₱117.78 billion a year earlier. The increase of ₱17.84 billion was largely credited to the remarkable performance of gold, supported by silver and copper.

Gold prices consistently traded above $3,000 per troy ounce and hit an all-time high of $3,354.35 in June. Silver mirrored the momentum, climbing to $35.86 per troy ounce. Copper averaged $4.28 per pound, up 6.6 percent year on year. Nickel, however, slipped to an average of $6.98 per pound as oversupply and weaker demand weighed on the market.

“Investors have flocked to gold as a safe-haven asset amid geopolitical tensions, tariff uncertainties and sustained central bank buying,” said a senior industry official who requested anonymity.

Precious metals dominate

Gold and silver remained the backbone of the sector, contributing nearly 60 percent of total metallic output, or ₱81.21 billion. Nickel and its by-products came second at ₱39.87 billion, while copper generated ₱13.71 billion. Chromite and iron ore together made up less than 1 percent.

Gold output rose 6.2 percent to 14,493 kilograms, with its value surging 45.6 percent to ₱79.82 billion. The top producers were Philippine Gold Processing and Refining Corp. in Masbate, OceanaGold Philippines Inc. in Nueva Vizcaya and Apex Mining Corp. in Davao de Oro.

The Bangko Sentral ng Pilipinas also ramped up purchases, buying 4,371 kilograms valued at ₱24.18 billion, further boosting demand.

At the regional level, the Bicol Region, Cagayan Valley and Davao Region emerged as leading gold producers, with much of the output shipped overseas to Switzerland, Hong Kong and India.

Silver production also improved, rising to 24,038 kilograms valued at ₱1.39 billion, up from ₱1.14 billion a year earlier. TVI Resources Development (Phils.) Inc.’s Balabag Project led production, followed by Apex Mining and OceanaGold.

Nickel under pressure

While precious metals thrived, nickel mining struggled. The combined value of nickel ore, mixed nickel-cobalt sulfide (MNCS) and scandium oxalate fell by ₱7.55 billion to ₱39.87 billion. Direct shipping ore volumes dropped almost 24 percent to 12.12 million dry metric tons (DMT).

Caraga, the country’s nickel hub, produced the lion’s share at 36.6 percent, followed by Eastern Visayas, Central Luzon, Mimaropa, Davao and Cagayan Valley. Several companies reported steep declines, including Rio Tuba Nickel Mining Corp., which cut output by more than half, while Citinickel Mines and Development Corp. recorded no production.

China and Indonesia remained the top destinations for Philippine nickel, with Indonesian imports rising to feed its growing smelter industry.

Copper steady, chromite falls, iron ore rises

Copper output fell 15.2 percent to 120,389 DMT, but higher prices lifted its value slightly to ₱13.71 billion. Carmen Copper Corp. accounted for more than half of the country’s total copper output, though its production fell sharply. OceanaGold’s output rose, offsetting declines from Philex Mining and Carmen Copper.

Chromite production slid 37 percent in volume and 44 percent in value, while iron ore was the lone bright spot outside precious metals. Ore Asia Mining & Development Corp.’s Camachin Project in Bulacan doubled its production, pushing iron ore value to ₱248.67 million.

Government revenue climbs

The government collected an estimated ₱3.11 billion in excise taxes from mining in the first half of the year, led by gold mines at ₱1.62 billion. Nickel contributed ₱890 million, copper ₱560 million, and chromite and iron ore ₱40 million combined.

Royalties from mineral reservation areas amounted to ₱940.24 million, distributed between the national and local governments under existing mining laws. OceanaGold alone paid nearly ₱467 million in additional government shares under its financial and technical assistance agreement.

Potential still untapped

Despite the strong numbers, MGB data showed only 2.62 percent of the country’s total land area is covered by mining tenements, equivalent to about 787,279 hectares. This is a fraction of the nine million hectares identified as having high mineral potential.

“The Philippines remains under-explored compared to its neighbors,” said one mining executive. “Unlocking this potential responsibly could further strengthen our role as a key supplier of critical minerals for the global energy transition.”