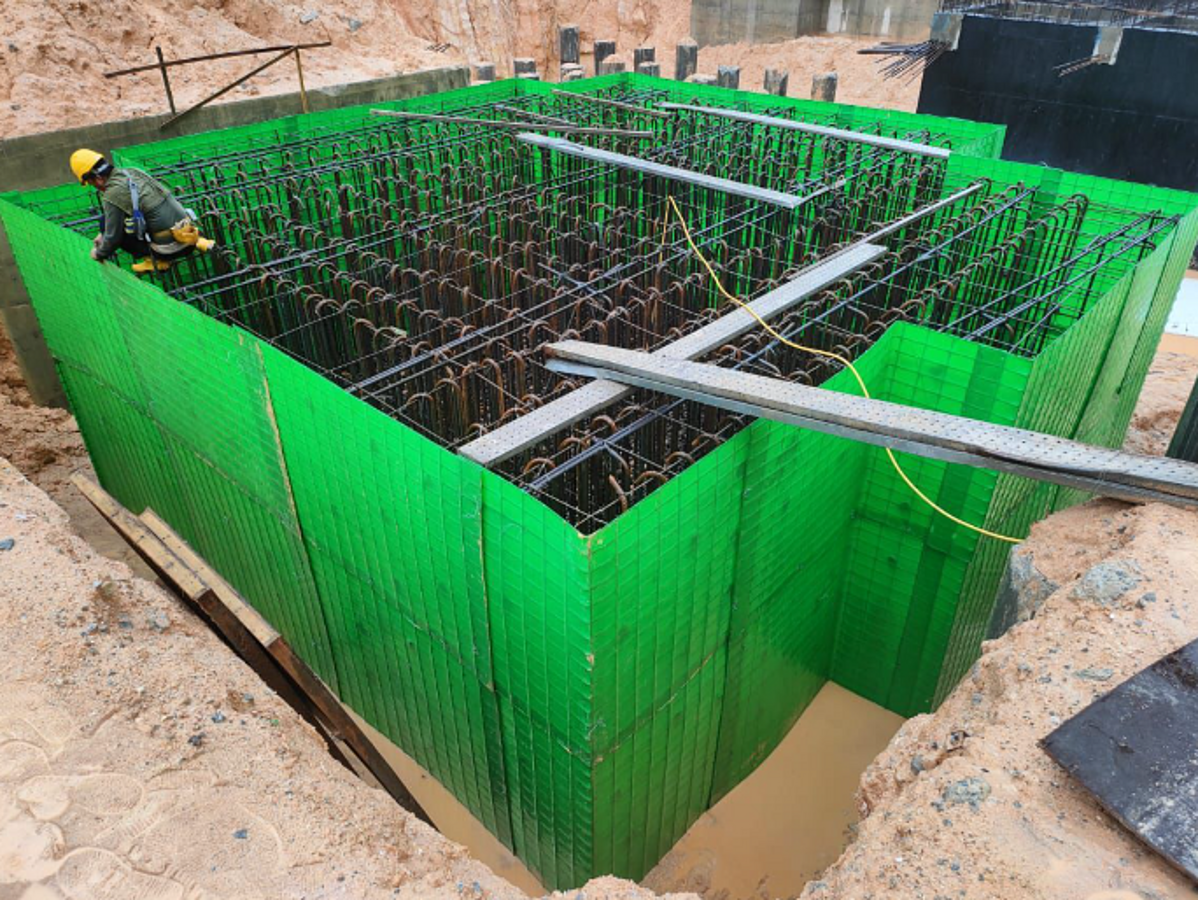

Photo Credit: Atlas Consolidated Mining and Development Corporation

Atlas Consolidated Mining and Development Corporation ("Atlas Mining") reported net income on Php1.94 billion for the first half of 2021 compared to the net loss of Php190 million for the same period in 2020. Net income improvement benefitted from higher metal prices and improved production and shipment volumes in the second quarter.

Metal prices rose in the second quarter this year with average copper price higher by 70% to 4.21/lb and gold price by 10% to USD1,812/ounce compared to the same period last year.

Atlas Mining's wholly-owned subsidiary, Carmen Copper Corporation, reported higher copper production and shipments in the second quarter compared to the first quarter due to improvement in grades and milling tonnage. Quarter-on-quarter, copper metal produced increased by 43% from 15.93 million lbs to 22.80 million lbs while gold produced increased by 9% from 5,346 ounces to 5,829 ounces. Year-on-year, copper metal production decreased from 54.17 million pounds in 2020 to 38.73 million pounds in 2021, due mainly to the decrease in copper grades by 26% from 0.311% to 0.231% as ore milled in the first quarter was sourced from stockpiles. Gold production decreased year-on-year by 51% from 22,815 ounces to 11,176 ounces due also to lower gold grades from 7.68 grams/dmt to 5.09 grams/dmt.

Cash costs decreased by 10% year-on-year from Php4.75 billion in 2020 to Php4.26 billion in 2021, due to overall lower volumes of shipments and production. Earnings before interest, tax, depreciation and amortization (EBITDA) was Php4.932 billion for the first half, 46% higher compared to Php3.373 billion in 2020. Core income for the period was Php2.158 billion in 2021 compared to Php366 million in 2020.

Based on its improved earnings, efficient operations and positive outlook, Atlas Mining continues to improve its balance sheet.

Article Courtesy of Atlas Consolidated Mining and Development Corporation