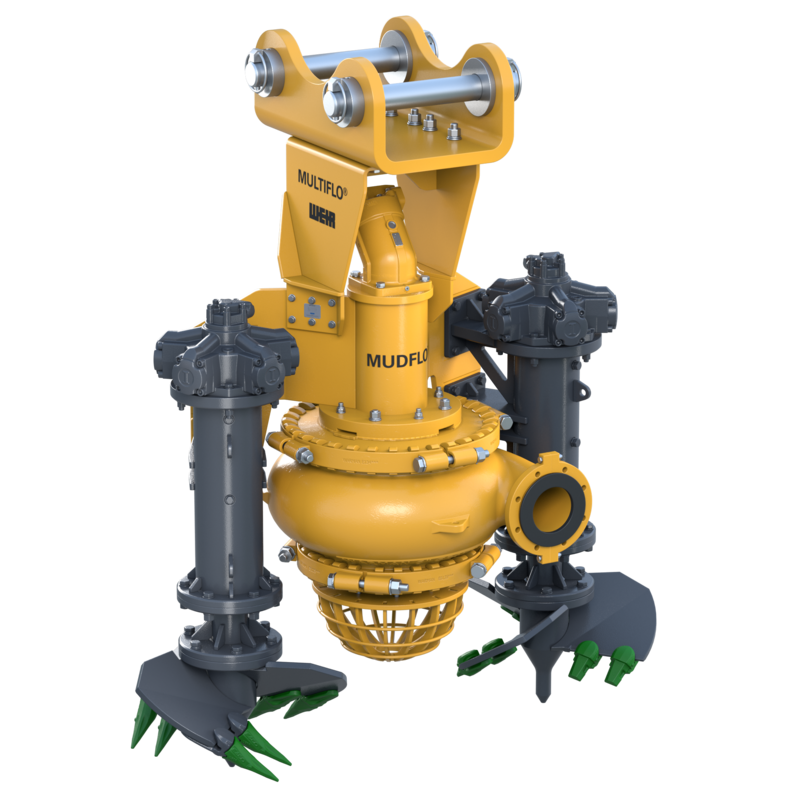

Multiflo® MudfloTM pump and dredge unit before installation in Indonesia

Weir Minerals, global leader in the provision of mill circuit technology, dewatering solutions and services, has launched the new Multiflo® MudfloTM hydraulic submersible slurry pump. Engineered for abrasive applications and large particle handling, the Multiflo® MudfloTM pump features a hydraulically driven wet-end specifically designed to efficiently and safely reprocess and relocate tailings ponds, maintain water retention dams and manage slimes and sludge ponds.

The innovative solution combines the Warman® MGS pump-end, Multiflo® CB32 hydraulic cutters and ESCO® excavation teeth to provide efficient pumping of highly charged and abrasive slurries.

Weir Minerals' unique Ultrachrome® A05 chrome alloy impeller ensures high wear resistance and the specially engineered suction strainer minimises the risk of clogging by preventing large solids & debris from entering the pump. Drawing on decades of Warman® pump design experience, the Multiflo® Mudflo™ pump is capable of pumping between 150 and 1,200m3/h, up to 82m head.

The Multiflo® CB32 hydraulic cutters feature market-leading ESCO® Ultralok® tooth system to prevent premature breakage, avoid tooth loss and protect the integral locking system to ensure the continuous operation of the pump.

Engineered by the Weir Minerals dewatering pump experts in Australia, it is available for global customers from July 2021.

“The Multiflo brand is synonymous with high quality and long-lasting equipment. In designing the Mudflo pump, our dewatering experts drew from the very best Multiflo, Warman and ESCO technology and used advanced hydraulics to create an innovative and cost-effective new solution for mine dredging applications,” Cameron Murphy, Director of Dewatering Weir Minerals APAC said.

Weir Minerals understands that success is built from enduring partnerships based on close collaboration and a mutual commitment to safety and technical excellence.

“It is not uncommon for sites to use a combination of pumps, shovels, excavators and trucks for dredging applications. When one of our long-time partners in Indonesia contacted us about developing a custom solution for the slurry build-up in their sumps, we knew we could provide a better solution,” Geoff Way, Weir Minerals Dewatering Specialist said.

“We’re problem solvers. We considered our customer’s pain points and engineered a new solution to efficiently and safely manage their site processes,” he said.

The Multiflo® MudfloTM pump can also be retrofitted to competitor OEM equipment; the quick-hitch plate attachment ensures convenient installation and removal from hydraulic excavators.

The Multiflo® Mudflo™ pump can be assembled on land, eliminating the safety risks associated with assembling pumps over water. Furthermore, the new hydraulic hose management system reduces the risk of hose entanglement and trip hazards, all the while providing a reliable hose bend radius to ensure smooth oil flow.

The Multiflo® MudfloTM pump will be available globally from July 2021. Discover more at https://info.global.weir/mudflo