Night cityscape in Indonesia [Photo credit: Abd Katon]

commentary written by George Bujtor, with foreword by Marcelle Villegas

When Indonesia announced the reimposition of their nickel export ban in 2019, why were many key players in the Philippine mining industry optimistic about this? Was their optimism based on the belief that Indonesia is out of the game due to their nickel export ban? Did the Philippines really benefit from Indonesia’s export ban on laterite nickel ores?

What actually happened is that during the years when Indonesia halted their laterite nickel ore exports to the world, outsiders still got their nickel supply from Indonesia by investing in the country, thus giving them internal access to Indonesia’s nickel. This investment strategy brought a win-win situation to both Indonesia and their foreign investors. This is an angle of the Indonesian nickel export ban story which is disadvantageous to the Philippine nickel industry. But are the industry players in the Philippines aware of this?

To give an in-depth analysis on what really happened to the Philippine nickel industry while Indonesia was implementing their nickel export ban, top Australian mining executive and CEO of Electric Metals Limited, George Bujtor shares his thorough research about the matter.

For background, George Bujtor has extensive work experience in technical, financial and commercial aspects of mining operations. He is one of the authors of a paper titled “A Guide to the Understanding of Ore Reserves Estimation”.[1] The paper was published by the Australasian Institute of Mining and Metallurgy in March 1982 and was the basis for the development of the JORC Mineral Code used worldwide today. This study is a remarkable peer-reviewed journal and significant reference of most international mining studies and academic research in relation to JORC studies and Mineral Reporting Code.[2]

His career is notable as past General Manager and Managing Director during his 22 years in Rio Tinto, Australia, and as former CEO of Aldoga Aluminium, Australia. On his first years in the Philippines, he developed the Berong Nickel mines in Palawan as CEO of Berong Nickel Corporation. Following this, he became the CEO of Carmen Copper Corporation/Atlas Mining where he successfully raised over US$200M in bond issue for the expansion of the mine and processing operations.

He held numerous Board positions and is a Fellow of the Australasian Institute of Mining and Metallurgy, and is a Competent Person as defined by the JORC & NI 43-101 codes (Australasian Joint Ore Reserves Committee).

Here’s an extensive report, analysis and forecast by George Bujtor about the current situation of the Philippine nickel industry.

---

Indonesia banned the export of laterite nickel ores in 2014 and went all out in developing its value-added nickel processing industries. In seven years, over US$30 billion has been invested into NPI (nickel pig iron) production facilities and stainless-steel plants with associated power stations, infrastructure development, industrial zone developments, skills development, employment opportunities, and so on.

Today, there are over 115 RKF plants (Rotary Kiln Electric Arc Furnaces) and 3 stainless steel plants operating in Indonesia. Yearly, these process plants convert over 50 million tonnes laterite nickel ore into approx. 800,000 tonnes nickel metal in the form of NPI, stainless steel sheet and sections, etc. The value-added nickel products generate over US$15$B billion in revenue every year, some 15 times higher than if the country exported unprocessed laterite ores.

In the same time horizon, from 2014 till today, there has been ZERO investment in value added nickel processing in the Philippines. This has resulted in a massive lost opportunity for the Philippine economy and its people. Short-term thinking, the lack of a coherent minerals policy and the lack of an ore export ban has rendered the once promising nickel industry in the Philippines irrelevant. The export of laterite ores to China will inevitably disappear as Chinese RKF plants and blast furnaces operations relocate to Indonesia for cost and environmental reasons. The Philippines will be left with abandoned mines and impoverished communities, and no stainless-steel industry.

Some pertinent questions one can ask include: Where is the development road map proposed by the Philippine Nickel Industry Association in 2019? Why is the Chamber of Mines not being proactive and pushing for in-country value added processing? Where is the Government resource policy to address the wholesale exporting of unprocessed ores? Will the Philippines ever have a stainless-steel industry?

This is a two-part series of articles on the Philippine laterite nickel Industry:

Part 1 – How Indonesia Beat the Philippines to Become the World’s Undisputed Nickel Pig Iron (NPI) Producer

Part 2 – Will the Philippines be Able to Succeed in the Battery Feedstock sector and Become a Battery Cell Producer?

Philippine Laterite Nickel/Cobalt in Perspective

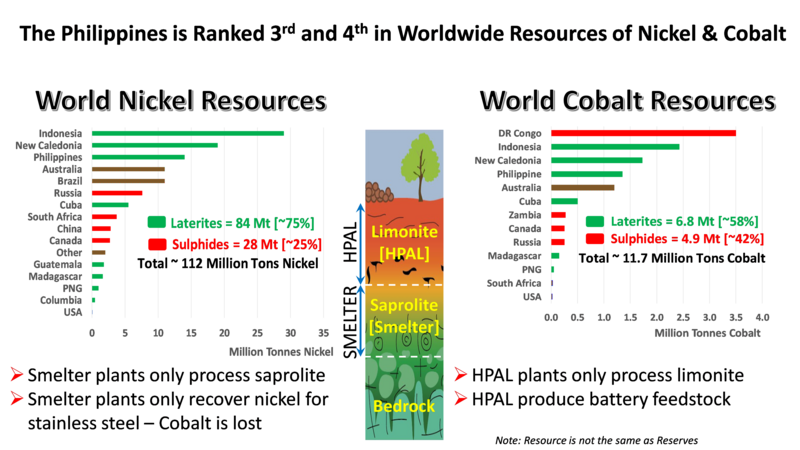

The Philippines has the world’s third largest resource of nickel metal in laterite ores (~14Mt contained nickel) and the world’s fourth largest resource of cobalt metal (~1.3Mt contained cobalt):

This is an enviable position and one which should confer considerable advantages to the host country. Unfortunately, the Philippines has not capitalized on its industry leading position.

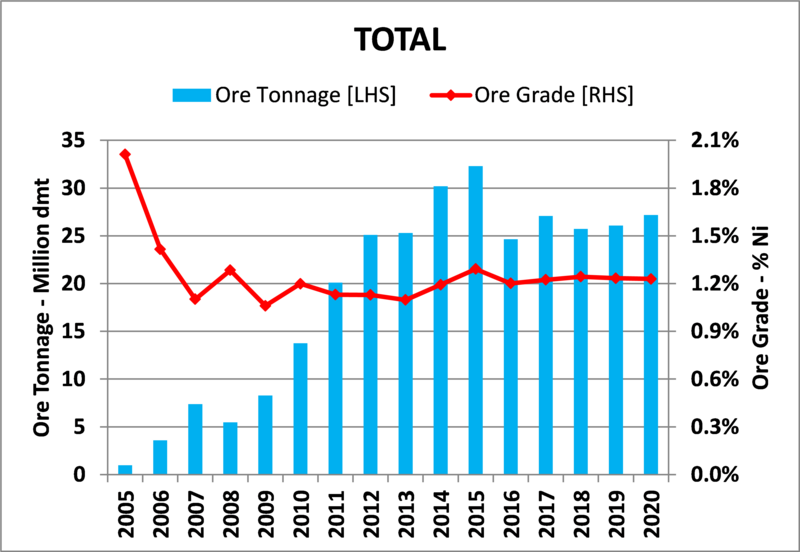

Between 2005 and 2020 inclusive, the Philippines had exported in total ~300 million tonnes of laterite ore averaging ~1.2% Ni and containing some 3.6 million tonnes contained nickel metal. Over the last five years, exports averaged ~25Mt per year laterite containing ~300,000 tpy contained nickel. Most of the laterite nickel was exported to China to feed the numerous NPI plants and blast furnaces servicing the stainless-steel industry.

As reported by the MGB, the revenue generated from the export of the ~300Mt of laterite ore amounted to approx. US$7.8B (equivalent to ~US$28/t ore). Whilst this may seem like a lot of money, it is an extremely poor return for the Philippines. Had this laterite ore been converted to NPI or stainless steel, the revenue would have been over US$65B to US$75B, some 8 to 10 times higher. Regional economic development would have been much higher, more extensive, and sustainable.

In contrast, in 2021 Indonesia is forecast to export ~800,000 tonnes contained nickel metal in NPI which is conservatively valued at ~ US$15B. This is some 10 times the value which might have been generated from the export of the ~50Mt of laterite ore.

The Philippines has always favoured the export of laterite ores over in-country processing and continues to do so. Mining companies celebrated on hearing Indonesia had banned the exports of laterite ore. However, this is all short-term thinking and does not recognizing the consequences over the medium term. The “quick” returns from the direct shipping of ore will be short lived and certainly not in the national interest. High grading of the remaining laterite deposits is just one consequence.

The Indonesian Ban on the Export of Unprocessed Ores

Indonesia introduced a ban on the export of unprocessed laterite nickel ores in 2014 after passing legislation in 2009 and providing the industry with a five-year grace period. Only Tsingshan took the Governments legislation seriously. At the time of the ban, Indonesia was exporting over 41 million tonnes laterite ore to China. The short-term pain was a silver lining in disguise.

The export ban was specifically intended to force the nickel ore miners to invest in value added processing. History shows the impact has been profound and Indonesia has emerged as the world’s dominant producer of nickel over the last 7 years. The export window opened a little in 2017 to help ore miners to raise funds to build processing plants but was firmly shut again at the end of 2019.

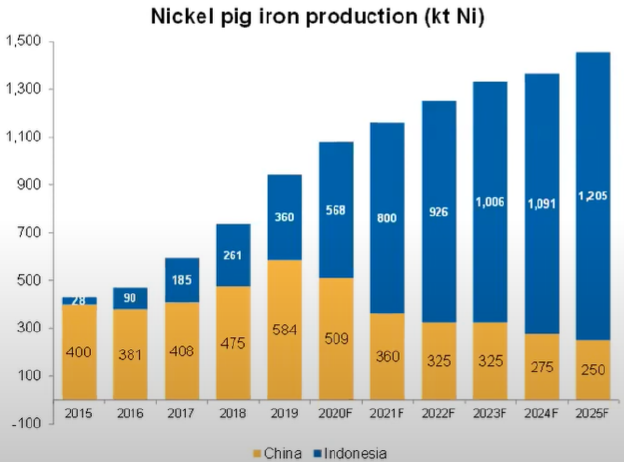

The impact of the export ban resulted in two investment waves. The first wave involved Chinese NPI operators relocating and ‘offshoring’ to Indonesia as shown in the chart below. Tsingshan led this first wave and is the dominant producer of NPI in Indonesia.

Today Indonesia produces more NPI than China, and by 2025 will produce ~5X the tonnage of Ni in NPI.

The offshoring of nickel plants to Indonesia is expected to continue and will result in a diminishing market for laterite ores from the Philippines. As shown, NPI production in China

is forecast to fall to 250,000 tpy contained nickel by 2025. With NPI production costs being 30% to 40% cheaper in Indonesia, the offshoring of Chinese production plants is likely to accelerate. This is all bad news for the Philippines’ nickel export industry.

The second wave of investment involved the building out of stainless-steel plants using the hot metal feed from the NPI furnaces. This was likewise led by China’s Tsingshan. Today there are three stainless steel plants in Indonesia with further plants planned.

To date, over US$30B has been invested by mainly Chinese companies in nickel processing plants in Indonesia. In the same time horizon, there has been no investment in the Philippines. We should not be surprised. Why invest in the Philippines when laterite ore can still be easily purchased and there is no export ban?

The lack of nickel investment in the Philippines has been due to a number of factors including – failure to implement a coherent minerals policy, excuses by mining companies about the lack of electricity, most mining companies chasing the quick “buck”, “greed”, and overall lower laterite Ni grades compared to Indonesia. The Indonesia Government made the hard decisions and has been rewarded accordingly. Companies investing in Indonesia built their own power stations to underpin their operations. The same could have been done in the Philippines.

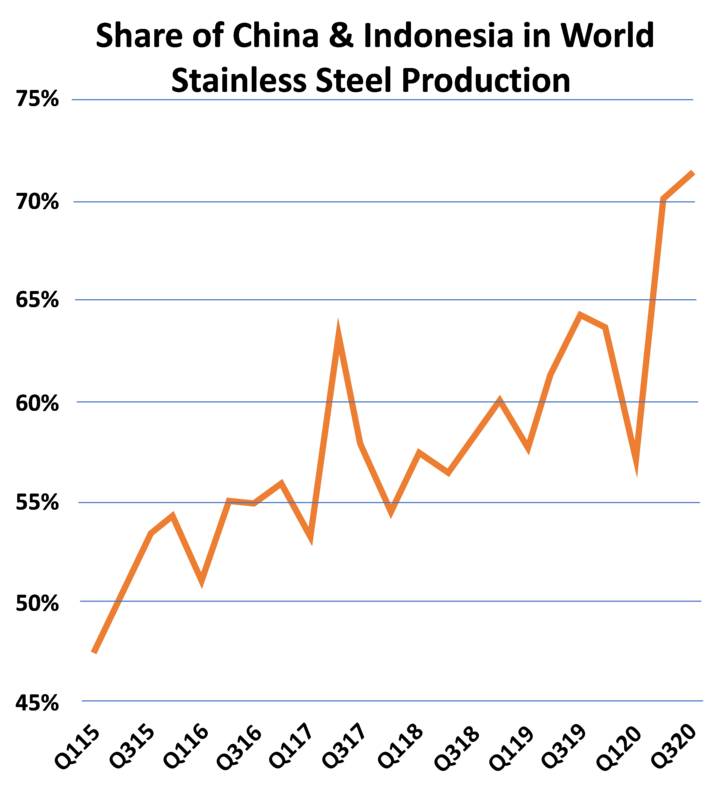

Indonesia and China now Control the Stainless-Steel Market

Indonesia and China now control the stainless-steel market and account for over 70% of worldwide stainless-steel production. This dominant position will only increase as more NPI plants and stainless-steel plants are built in Indonesia. By 2025, Indonesia and China will produce a combined annual 1.5Mt of Ni metal equivalent in NPI, amounting to >50% of worldwide primary nickel supply. This has all been on the back of the export ban of laterite ore.

Would an Ore Export Ban Today Help the Philippines Recover its Lost Position in Stainless Steel?

The answer is very simply ‘No’. The race has been run and won by Indonesia. This was all predictable many years ago especially after Indonesia banned ore exports in 2014. It is almost impossible now to entice investors into NPI/Stainless steel in the Philippines. The NPI and stainless-steel market is fully controlled by China and its large corporations. Even if the Philippines were successful, it would always be a price taker and never a price setter.

The only option available for the Philippines is to watch its laterite ore export market for NPI/Stainless steel slowly disappear. This is inevitable.

Indonesia has become the envy of many countries on its successful policy of resource nationalism. The Indonesian laterite nickel ore boom has morphed into a stainless-steel boom and may soon become a battery-materials boom.

Having lost the race for dominance in the NPI/stainless steel boom, is the Philippines positioned to take advantage of the battery-materials boom?

This and other questions will be answered in Part 2 of this series: Will the Philippines be Able to Succeed in the Battery Feedstock sector and Become a Battery Cell Producer?

-----

Reference:

[1] http://jorc.org/docs/historical_documents/kng_mcmahon1982.pdf

[2] http://www.jorc.org/

-----

Photo credit:

Top photo - Night cityscape in Indonesia by Abd Katon, https://pixabay.com/users/katon765-12184997/