The Canadian Chamber of Commerce of the Philippines hosted an online Business Briefing on Jan. 25, 2024, Thursday. This is the first of their series for the year with the title "Mining: Update on Major Issues".

CanCham President, Julian H. Payne hosted the online event along with CanCham's Assistant Corporate Secretary, Maria Rowena Gempesaw-Cuyno, with Atty. Odette Javier of Lepanto Mining as moderator.

Speakers include Atty. Ronald Recidoro (Executive Director of the Chamber of Mines of the Philippines - COMP), Karlo Fermin Adriano (OIC-Undersecretary, Department of Finance), Malyn Molina (President, EON Group), and Atty. Dennis Quintero (Partner, Quisumbing Torres).

As an overview of the briefing, "There have been significant changes in mining practices, government regulation, and public understanding about large-scale mining in the Philippines in recent years. The economic benefits and risks have become clearer. The proposed new fiscal regime for mining will have a major impact on the interest of international mining companies and their foreign investors in mining in the Philippines. The future of mining in the country is at a critical juncture."

The objective of the discussion is primarily to inform and clarify the impact of the proposed new fiscal in additional costs and benefits of mining for the national government, local governments and their communities, and mining companies. Secondly, the discussion covered the current attitudes of Filipinos in both mining and non-mining communities about large-scale mining as reported by a survey done by EON Group. Lastly, the briefing mentioned to what extent international mining companies and their foreign investors are now viewing the Philippines as an attractive country to launch new mining operations as reported by Department of Finance.

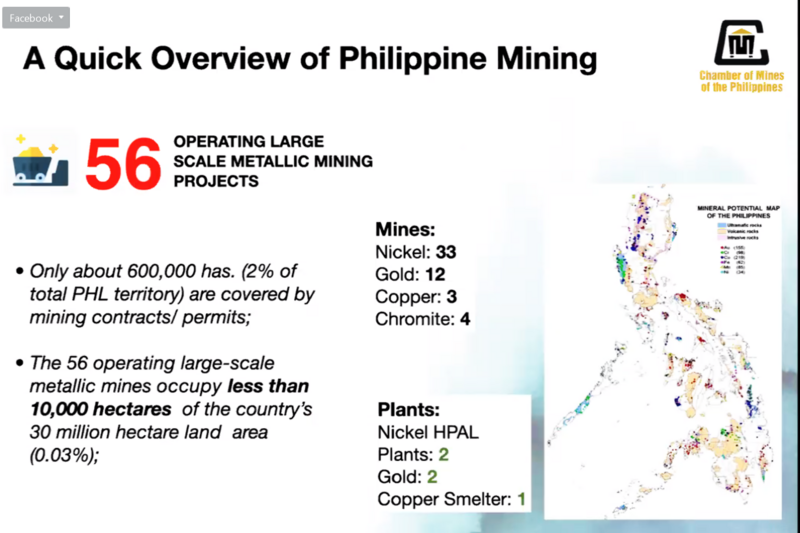

On the presentation “Philippine Mining: Legal and Policy Updates”, Atty. Recidoro discussed the opportunities, regulations, and taxation. He gave a quick overview of Philippine Mining. There are 56 operating large-scale metallic mining projects where only about 600,000 hectares (2% of total PH territory) are covered by mining contracts and permits. The 56 operating large-scale metallic mines occupy less than 10,000 hectares of the country's 30 million hectares of land area (0.03%).

To mention some metallic mining industry facts and figures, the total Philippine exports are worth $7.23 billion (9.17% of total PH Exports), Php44.8 billion or 1.17% of total taxes comes from mining, mining generates Php153.1 billion Gross Value Added (GVA) or 0.7% of total GDP. There are approximately 208,778 people working in mining companies. This is 0.46% of the total Philippine workforce.

“For such a highly mineralized country, the large-scale metallic mining sector does not substantially contribute to the national economy. The industry has been stymied by policy problems, resulting in no new investments and therefore no growth.”

Atty. Recidoro pointed out some policy shifts in the last decade that affected the industry. There was EO79 by President Aquino in 2012 that placed a moratorium on new mining projects. In 2016, President Duterte appointed the late Gina Lopez, an anti-mining activist as DENR Secretary. On the following year, Sec. Lopez ordered an audit of all mining operations and initiated the abrupt closure/suspension of 28 mines. On the same year, Sec. Lopez placed a ban on new open pit mining. In 2018, Congress passed the TRAIN Law that increased the excise tax on minerals to 4% of gross output.

President Duterte issues EO130 in 2021 lifting the moratorium on new mining projects. On the same year, DENR Sec. Cimatu issues DAO 2021-40 which lifts the ban on open pit mining.

In 2022, President Marcos bats for mining and orders DENR to strictly implement environmental laws. Finance Sec. Ben Diokno banks on mining for post-COVID recovery.

Regarding the amendment of the Philippine EIA system, Atty. Recidoro mentioned some key features of the bill include re-orienting the nature and purpose of the EIA System as a planning tool and renaming the ECC as Certificate of Proponent's Environmental Commitment (CPEC). Another key feature is the introduction of a Strategic Environmental Assessment (SEA) for proposed policies, plans, or programs.

He also mentioned the approval of the new fiscal regime for large-scale metallic mines (HBN 8937) with key features such as: a lowered royalty for those operating in MRs--from 5% down to 4%; a royalty for LSMs operating outside of mineral reservations, but which is conditioned on income; windfall profits tax that operates in the same way but which only kicks when the company achieves a "windfall" which starts at a profit margin of 35%; and provisions for thin capitalization, transfer pricing, ring-fencing, and fiscal transparency.

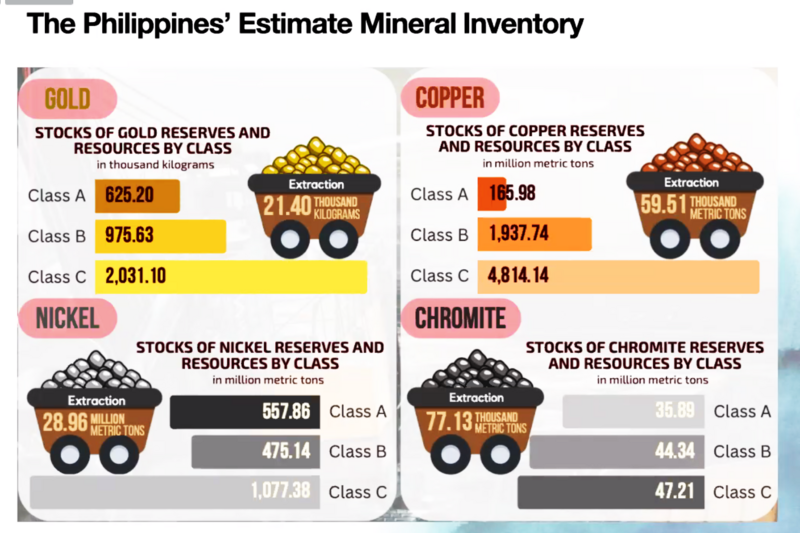

On Usec. Karlo Adriano's report titled "Rationalization of Mining Fiscal Regime", he provided an overview of the mining industry. He said the Philippines is geographically endowed with abundant mineral resources as copper, gold, nickel, and chromite. He said that 9 million hectares are identified as having high mineral potential but only 779,446.41 hectares or 2.60% are covered by mining tenements as of June 2023. For the estimated value produced in 2022, he gave the following figures: gold = Php91.05 billion, nickel and nickel products = Php117.64 billion, and copper = Php25.67 billion.

Usec. Adriano also reported that according to the Fraser Institute, the Philippines has one of the best mineral potentials, but the current policies do not encourage investments in the sector.

He also reported that the discussion of a new mining fiscal regime has been ongoing since 2021, which is one of the challenges surrounding it. Other challenges include factors like having several mining fiscal regimes, resulting in complex tax system, and the Average Effective Tax Rate (AETR) or government’s take on mining is relatively high compared to peers.

On the presentation titled “Unearthing Opinions: Exploring Filipinos' View on Mining through Data Insights” by Malyn Molina, she reported the results of a public survey about the reputation of the industry and how well lay people understand what mining does for the Philippines. Molina is the President and CEO of EON Group. Molina is a highly accomplished communications expert.

"In a local landscape where responsible mining has yet to be acknowledged as a reality, and data on the topic is limited and low in visibility, how did we discover the starting point in building the trust narrative for the country's mining industry?"

"Through our survey, we affirmed that many people still associate mining to the same disturbing outcomes caused by climate change."

“The positive contributions of the industry and the benefits it provides fall behind in terms of awareness. However, the data also shows clear opportunities to shift public perception.”

“Many people have yet to see the care and integrity that goes into the process. Mining has yet to be established as a value chain rather than just plain extraction. There are already human-centric processes in place that address what they are looking for. We just have to show them the bigger picture.”

Covering online news and social media, their study shows that there are approximately 4.4K mentions of the Philippine mining industry and related topics. Among these articles, 75.7% are positive stories, 8.1% are negative stories, and 16.2% are neutral.

The last speaker for the business briefing was Atty. Dennis A. Quintero, Head of Energy, Mining, and Infrastructure Industry Group at Quisumbing Torres Law Offices. He heads the PMRCC Membership Committee and member of the Legal Committee of the Chamber of Mining of the Philippines.

Atty. Dennis Quintero provided an in-depth rundown of the history of the Philippine mining industry, supplementing on the timelines provided by Atty. Recidoro.

His discussion started in 1995, during the time of President Fidel V. Ramos when the country has the current Mining Act. It was an era when the government extensively promoted exploration and mining to foreign investors, which resulted in major and junior mining companies investing here. There were some major foreign companies that came to the Philippines to undertake exploration works.

The government's attitude back then changed to a policy of mere tolerance of mining which later shifted to active promotion during the time of President Gloria Macapagal-Arroyo in 2002.

Atty. Quintero said, "This also coincided with the decade of the mining boom globally from 2002 to around 2011 to 2012."

"The Philippine mining sector experienced a slowdown starting in 2012, which was the tail end of the global mining boom of the 2000s. And this was also coupled by the issuance of Executive Order No. 79 which instituted a moratorium or a stop on new mineral agreements until a new Mining Fiscal Regime Law was passed by Congress."

"The reality during that particular period up until 2016 was that the government afforded very little opportunity for dialogue with the private sectors as the Philippine mining industry stagnated."

Moving forward, in 2020 until the present time, there is now a focus on downstream nickel processing to take advantage of the country's position as top producers of critical minerals, namely: nickel, copper and cobalt. These minerals are used for battery storage systems that are employed in electric vehicles and renewable energy system. In 2022, the new government under President Bongbong Marcos recognized the Philippines in its unique position to be an important player in the clean energy transition and a critical partner in realizing development goals.

“The government has stated that a resilient and sustainable mining industry can support the country's economic and social development. DENR also stated that developing the country's mineral resources is not only beneficial to the country, but should be regarded as essential in transitioning to a decarbonized society.”

As an effect, by 2022, the doors are now open for a direct dialogue and consultation between the government and private sector. “This is offered with the aim of realizing the shared goals of the state and the mining industry, for the development of the upstream and downstream sectors of the industry.”