(Part One of Two)

Written by Noel B. Lazaro, Eveart Grace P. Claro, Judd Yonder L. Reyes, and Marielle D. Marbella

In the foothills of Brooke’s Point, Palawan, the air is thick with purpose as workers press seedlings into the earth, each one a small promise for a greener future. Two years into its operation, the Ipilan Nickel Project has planted nearly three million seedlings. Yet, while the commitment to reforestation is clear, the challenge lies not in the availability of seedlings or the manpower to plant them, but in securing suitable land for these young trees to thrive within the municipality’s 85,064.90 hectares. Afforestation of previously scorched mountainsides and agroforestry initiatives are underway.

By May 2024, mining companies had planted over 55 million seedlings in more than 50,000 mined-out areas, expecting a survival rate near 90 percent. Tree planting can help local communities, but it is not a complete answer.

Mining drives the world’s economy, providing raw materials vital for industries. The World Economic Forum notes that half of global GDP relies on natural resources. But mining comes with heavy costs. A 2020 McKinsey report estimates that mining produces 1.9 to 5.1 gigatons of carbon emissions yearly, largely from coal-bed methane and energy use. In 2022, the Deloitte Economics Institute warned that climate change could lead to global losses of $178 trillion from 2021 to 2070. In the Philippines, the Nationally Determined Contributions (NDC) indicates that the mineral industry will continue to be a major greenhouse gas (GHG) emitter through 2030.

This article examines the challenges and opportunities for decarbonization in the Philippine mining sector.

GREEN (EV)OLUTION

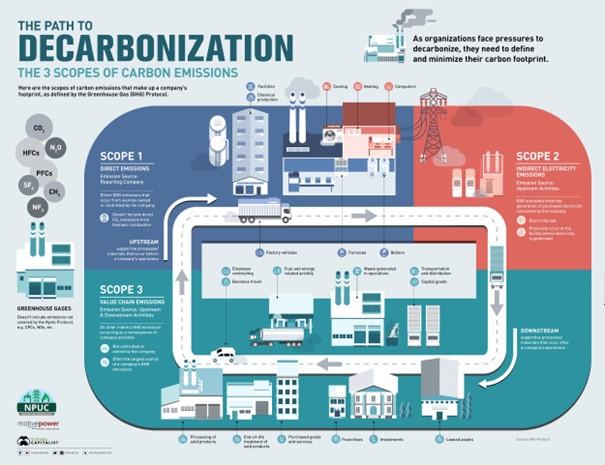

Decarbonization is essential for mitigating climate change by reducing or eliminating carbon dioxide (CO2) and other GHGs. It involves transitioning to cleaner energy sources and adopting sustainable practices to lower pollution. The ultimate goal is achieving "net-zero" emissions, where the amount of GHG released is balanced by the amount removed. Emission control can be achieved through natural methods like tree planting or watershed restoration, and the costlier technological solutions such as direct air capture and storage.

As the global community grapples with the urgent need for sustainable practices under the 2015 Paris Agreement, the Department of Environment and Natural Resources (DENR) has launched a "green transition" initiative. Secretary Maria Antonia Yulo-Loyzaga frames the transition as a “whole-of-society” effort, advocating for science and technology investments alongside social and ecological considerations. Her emphasis on promoting biodiversity, carbon footprint reduction, and effective waste management practices is a step in the right direction.

At the Nordic-Philippine Climate Executive Dialogue held on June 18, she advocated for “nature-based solutions” for carbon reduction, suggesting a preference for simpler, less costly strategies over more complex carbon capture technologies. However, nature-based solutions, while essential, must be part of a broader strategy that includes robust carbon and efficient regulatory frameworks and tech advancements to genuinely meet the country’s pledge to reduce GHG emissions by 75 percent by 2030.

The secretary highlighted the Philippine Ecosystem and Natural Capital Accounting System (PENCAS), which aims to quantify the value of natural resources, including minerals, to socio-economic development and includes addressing the impacts on ecosystems by adopting the mitigation hierarchy in mining operations, which follows the steps of avoidance, minimization, restoration, and offsetting compensation for affected communities. On the other hand, the DENR's recent release of the Implementing Rules and Regulations for the Extended Producer Responsibility Act of 2022, which mandates large companies to manage plastic waste, is a positive development.

The drive for modern infrastructure—encompassing electrification, renewable energy, automated systems, and AI-powered monitoring—represents a critical yet challenging evolution. In this context, electric vehicles (EVs) offer cleaner alternatives that reduce reliance on diesel machinery, which, according to a 2023 Mining Technology report, emits high levels of nitrogen oxides (NOx) and sulfur dioxide (SO₂). EVs are also safer and quieter, contributing to lower fire risks.

However, such transformations often require substantial investments that can be prohibitively high. Thus, the call for effective incentives is crucial, but details remain vague. For Atty. Dante R. Bravo, president of Global Ferronickel Holdings, Inc. (FNI) and Philippine Nickel Industry Association, Inc. (PNIA), the industry “needs clarity in terms of incentives for mineral processing” and “competitiveness given the size of investments required.”

The dialogue around margin-based royalties and windfall profit taxes is envisioned to help build a more equitable arrangement.

IN THE PIT OF CHANGE

The Chamber of Mines of the Philippines (COMP) has made a significant stride by launching the first phase of its Towards Sustainable Mining (TSM) initiative among its 19 members. This global standard for environmental, social, and governance (ESG) performance provides mining companies with essential tools to manage risks responsibly and adopt best practices. As the only ASEAN nation to adopt TSM, the Philippines sets a noteworthy precedent in the region.

The initiative focuses on vital areas such as health and safety, outreach to Indigenous Peoples, crisis management, tailings and water management, biodiversity conservation, and climate change. During the “Mining Philippines: Digging Deeper 2024” conference on October 17, four of eight randomly selected companies received the highest ratings across five key TSM protocols.

However, concerns remain regarding the scalability of these practices across the 56 large-scale metallic and 59 non-metallic mines, along with over 3,000 small quarries in operation. The voluntary nature of TSM and its reliance on self-assessment raise doubts about its effectiveness. Inconsistent adherence, particularly among non-members, could diminish the initiative’s overall impact.

This situation underscores the need for a more structured approach that transcends self-regulation. Regulators and legislators should take cues from TSM to develop a governance framework beyond existing mining laws and ISO benchmarks, potentially incorporating training and resource access.

TSM raises the compliance bar, but its success depends on overcoming limitations and fostering inclusivity.

CARBON CREDIT CARD

Investing in carbon rights is touted to be a more ingenious approach to offset carbon emissions. Generating a new source of income helps to meet financial objectives while also advancing global carbon reduction goals.

The proposed Low Carbon Economy Investment Act (House Bill 7705) aims to advance the Philippines' transition to a low-carbon economy. This legislation requires major GHG emitters to formulate decarbonization plans limiting global temperature increases to below 2°C. It also introduces a carbon pricing mechanism that imposes costs on emissions exceeding set thresholds, thereby creating a decarbonization fund. This fund is intended to be reinvested in sustainable, low-carbon initiatives, offering considerable opportunities for businesses and investors committed to sustainable development.

Concurrently, the Carbon Rights Act (House Bill 10635) is envisioned to overcome obstacles to investing in carbon forestry and related projects. This legislation clarifies ownership of carbon rights and establishes processes for their transfer, thus enabling better integration into global carbon markets. For investors, particularly those focused on nature-based solutions, this act opens new avenues for investment in essential carbon projects intended to achieve global emission reduction goals.

Carbon trading involves the exchange of emission rights and credits that permit organizations to emit specific volumes of CO2. Companies can purchase credits to increase emissions or sell them to reduce emissions. This system allows mining companies to support biodiversity and restore ecosystems while generating revenue.

Atty. Analiza Rebuelta-Teh, DENR Undersecretary for Finance, Information Systems and Climate Change, recently disclosed that the Department of Finance is creating a framework for carbon finance while the DENR is working on the rules for carbon credits.

These legislative initiatives signify notable progress, yet substantial challenges loom. The effectiveness of the Low Carbon Economy Investment Act hinges on precise baseline emissions data, rigorous enforcement, and vigilant monitoring; without these, companies may underreport emissions or sidestep decarbonization commitments. In addition, the viability of the carbon pricing mechanism depends on businesses' capacity to adapt, requiring time to develop essential infrastructure and mitigate oversupply issues that have plagued other markets. Public backing for carbon pricing presents difficulties, particularly if it results in higher consumer costs; thus, clear communication of its benefits is essential. Furthermore, while the Carbon Rights Act aims to attract investment into carbon projects, potential investors may confront legal ambiguities, bureaucratic hurdles, and a lack of transparency. Ultimately, the Philippines must compete with other nations for carbon project investments, necessitating demonstrable benefits, a stable regulatory framework, and proactive policies to avoid the pitfalls faced by early carbon markets in the European Union.

Addressing these hurdles will be crucial for their successful implementation and maximizing the benefits of a transition to sustainable practices.

(To be continued…)

Noel B. Lazaro is a director and general counsel at Global Ferronickel Holdings, Inc. His practice spans diverse fields, including environmental litigation. He was an associate at SyCip Salazar Hernandez & Gatmaitan and a partner at Siguion Reyna, Montecillo & Ongsiako. A UP College of Law graduate, he teaches evidence, special proceedings, and special writs at law schools.

Eveart Grace Pomarin-Claro is the Corporate Secretary of Global Ferronickel Holdings, Inc. and the Executive Legal Officer at Platinum Group Metals Corporation. A University of St. La Salle College of Law graduate, she specializes in securities and capital markets, taxation, project finance, and mergers and acquisitions.

Judd Yonder L. Reyes is a research associate and paralegal at Platinum Group Metals Corporation. A Bachelor of Arts in Communication graduate (Magna Cum Laude) from Pamantasan ng Lungsod ng Maynila, she completed the 29th Foundation Course of the Paralegal Training Program of the University of the Philippines - Law Center.

Marielle Marbella is a research associate and paralegal at Platinum Group Metals Corporation. A Bachelor of Science in Life Sciences-Communication Track graduate (Magna Cum Laude) from Ateneo de Manila University, she has a background in journalism and supports the group’s sustainability programs.