The Philippines has long been known as one of the world’s most mineralized countries, but continues to grapple with unlocking its full mining potential. For decades, red tape, policy uncertainty, and public distrust have kept investors away, even as the country sat atop the proverbial pot of gold.

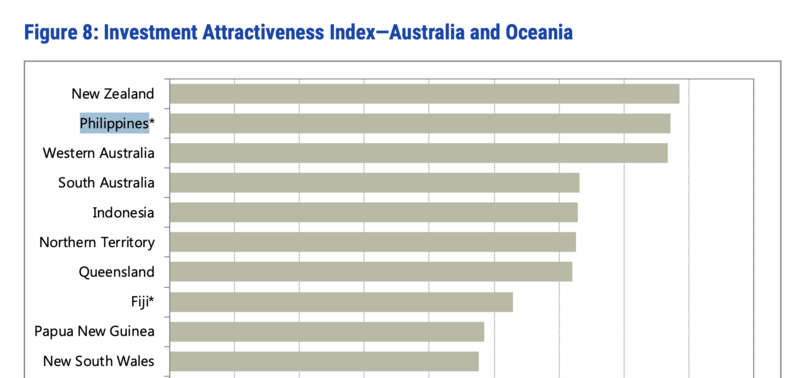

However, this year’s leap in the 2024 Fraser Institute’s Investment Attractiveness Index, from 72nd to 16th place among 82 countries, tells a new story: the Philippines is finally reclaiming its place in the global mining map.

This turnaround did not happen by chance. It is the result of deliberate policy reforms, sustained regulatory improvement, and a changing mindset within both government and industry.

The Department of Environment and Natural Resources (DENR) and the Mines and Geosciences Bureau (MGB) have, over the past few years, pursued a vision that balances growth with governance, an approach long overdue in a sector often viewed with suspicion.

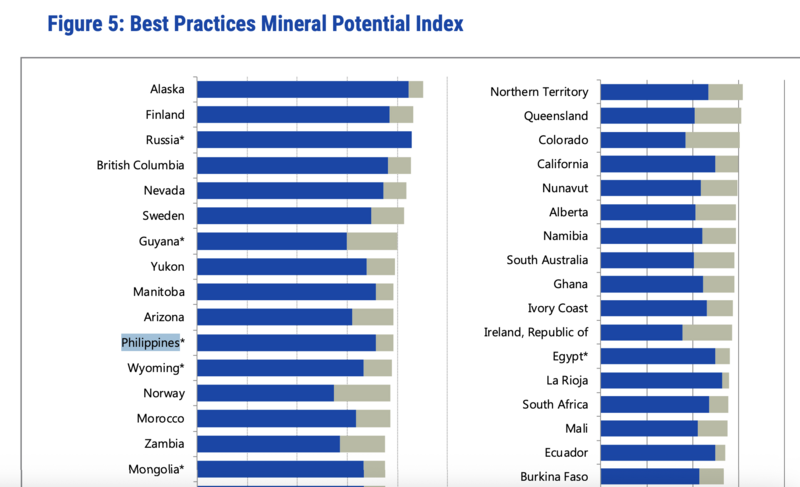

According to the Fraser Institute’s 2024 Annual Survey of Mining Companies, the Philippines’ score nearly doubled: from 36.89 in 2023 to 77.11 in 2024. This surge reflects two critical shifts: a stronger geological attractiveness ranking, now 9th globally, and a dramatic improvement in policy perception, from 79th to 25th. Simply put, the country’s potential is finally matched by a more predictable and transparent policy environment.

This progress may be traced to the reforms initiated by former DENR Secretary Maria Antonia Yulo Loyzaga, including streamlined permitting and digital transparency measures, and which are being continued by the current Secretary, Raphael Lotilla. While the aforementioned reforms are largely procedural, they nevertheless translate into predictability and clarity which investors value.

The numbers tell their own story. In 2024 alone, the mining sector generated ₱253 billion in production value, contributed ₱33 billion in taxes and royalties, and provided nearly 292,000 direct jobs.

Beyond economics, companies invested billions more in environmental protection, community development, and rehabilitation efforts, proof that responsible mining, once dismissed as an oxymoron, can indeed take root.

Other signs point to a resurgence in the mining industry. Aside from the sharp improvement in investment-attractiveness rankings, regulatory, fiscal, and policy reforms have likewise contributed to investor confidence.

The recent passage of the Enhanced Fiscal Regime for Large-Scale Metallic Mining Act (Republic Act 12253) introduces tiered royalty rates, windfall profit taxes, project-based ring-fencing, and other provisions that aim for fairness, environmental protection, and better revenue sharing.

Another factor is the rise in production values and asset valuation. Metallic mineral output value has increased mainly due to the “re-entry of projects” [following the lifting of the ban on new mineral agreements in 2021 via Executive Order 130, which allows for new mining projects to proceed] and strong commodity prices. The total value of mineral assets rose by 4.6% in 2024 (from ₱460.16 billion in 2023 to ₱481.45 billion) based on Philippine Statistics Authority data.

The increased global demand, especially for nickel, copper and other “critical minerals,” both from foreign investors and governments (e.g. U.S., China, EU) looking to secure supply chains for technologies like EV batteries, is also a major factor in the renewed attractiveness of the Philippine mining industry. Since much of the Philippines’ mineral wealth lies untapped, there is a wealth of opportunity for the next wave of responsible mining investment.

But not everything is rosy. Despite these positive outlook, many challenges remain. Regulatory enforcement, infrastructure gaps, and inter-agency coordination still need work. Reforms must therefore be sustained to turn optimism into long-term confidence.

The Philippines has the potential to become a leading supplier of critical minerals which are essential for the world’s shift to clean energy, but the government and private sector must continue working together.

The message from the Fraser Index is clear: investors are noticing. The Philippines is no longer seen as a high-risk frontier but as a credible, emerging hub for mineral development in the Asia-Pacific.

This is a far cry from 2017-2021 when the Philippines ranked much lower in the Policy Perception Index (PPI), often among the bottom 10 jurisdictions. For example, in the 2021 survey, the Philippines was listed among the worst jurisdictions in the PPI.

Beyond rankings and reports lies a deeper question: what kind of mining future do we want? A future where resources uplift communities and where the wealth beneath our soil powers not just global supply chains but, more importantly, local progress. If the government can sustain reform and accountability, this renaissance will not just be statistical: it will be structural and sustainable.

The Philippines has taken a major step forward in mining: the real test is to remain sure-footed in sustaining that momentum.