Philex Mining Corp. said its much-anticipated Silangan Copper and Gold Project in Surigao del Norte is entering the final stretch of development, with first metal production expected in the first quarter of 2026.

In a project update, the company reported that mine development has been progressing rapidly, particularly at Level 95 (L95), where production drifts are on track to be completed by February 2026. This will pave the way for the start of metal production by March next year.

Philex said it has already begun stockpiling ore that will be used to commission the processing plant by the end of January. So far, about 66,000 metric tons (MT) of ore have been stockpiled at the surface — enough to support a month of operations once the mine begins producing at its initial rate of 2,000 MT per day.

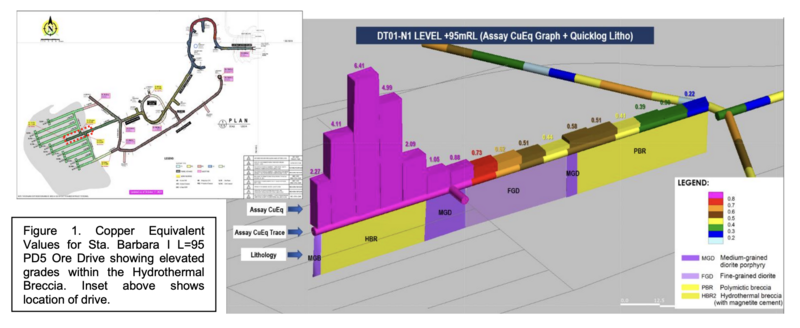

Recent assay tests have confirmed encouraging results. Samples collected from Production Drift 5 (PD5) at L95 showed the presence of high-grade mineralization consistent with the company’s 2019 PMRC-compliant Technical Report. According to Philex’s Competent Person for Exploration and Mineral Resource Estimation, the last 27 meters of high-grade ore returned average grades of 5.30 grams per ton (g/t) of gold and 2.0 percent copper.

Construction is also moving forward. The Process Plant is now 70 percent complete, while work on the Tailings Storage Facility (TSF) has reached 76 percent, including major progress on the main embankment, clean water dams, and pipelines.

The 6-kilometer tailings pipeline road connecting the plant and the TSF has been finished, and the High Voltage Switchyard is expected to be energized by January 2026. The main embankment, meanwhile, is already 85 percent complete.

“In a race, there are two important points: the start and the finish,” said Eulalio Austin Jr., Philex president and CEO.

“The runner needs a strong start and will exert his last force of energy closest to the finish line. This is what we in Philex, particularly with the Silangan Project, are doing now. We are now at the most critical part of the race, so we focus all our energy on winning at the finish line. We do this not just for our own success, but for the betterment of the lives of our stakeholders, particularly the host and neighboring communities. We owe it to them." Austin added.

Profit rebounds on higher gold prices

Alongside the construction progress, Philex reported a stronger financial performance for the third quarter of 2025.

The mining firm posted a core net income of ₱344 million (US$5.8 million) and EBITDA of ₱784 million (US$13.3 million) for the quarter, a solid jump from the ₱200 million (US$3.4 million) core net income and ₱506 million (US$8.6 million) EBITDA recorded in the same period last year.

For the first nine months of 2025, Philex booked ₱480 million (US$8.1 million) in core net income and ₱1.438 billion (US$24.4 million) in EBITDA. These figures were slightly lower than the ₱610 million (US$10.3 million) and ₱1.418 billion (US$24.1 million) posted in 2024, reflecting weaker copper prices despite gains from gold.

Average realized gold prices surged to US$3,642 per ounce in the third quarter, up from US$2,336 per ounce in the same period last year. Copper prices eased slightly to US$4.43 per pound, compared with US$4.59 per pound a year earlier.

Tonnage milled during the quarter came in at 1.771 million tonnes, producing 6,682 ounces of gold and 4.921 million pounds of copper.

With the Silangan mine nearing completion and gold prices staying strong, Philex said it remains focused on bringing the project to production on schedule and strengthening its long-term profitability.