The PH-EITI National Conference 2021 was held last July 29 with the theme "Resiliency in Transparency".

PH-EITI or Philippine Extractive Industries Transparency Initiative, is a government-led, multi-stakeholder initiative that implements EITI. The initiative started on 26 November 2013 under Executive Order No. 147, series of 2013. It is a government commitment first announced through EO No. 79, s. of 2012. The initiative aims to promote the open, accountable management and good governance of oil, gas and mineral resources industries. The three-hour webinar/conference featured various keynote speakers.[1]

“This is the second year that we are holding this meeting online due to the pandemic. This underscores the exceptional circumstance under which we have to operate into the foreseeable future. Nevertheless, I congratulate the EITI for its efforts to organize this national conference and produce an annual report despite all the challenges.” This was part of the Opening Remarks given by Hon. Carlos G. Dominguez, Secretary of Department of Finance.

He defended the importance of the extractive industries like mining despite the common belief of some groups that these are bad for the environment. “By their nature, the extractive industries involve multi-faceted and complex issues. It is easy to merely brand extractive practices as harmful to the environment. Regulations must ensure the balance between economic and environmental concerns to realize the best outcomes for our people.”

Sec. Dominguez explained that EITI helps in achieving that balance by providing fair and accurate data about the extractive industries by describing it as a credible source of information to aid policymakers on the proper fiscal regime for mining.

“…EITI enables the productive exchange of information and positive dialogue among stakeholders. This clears the air of misinformation… The most important value we need to uphold at all times is transparency. Without this, there will be constant suspicion and all sorts of unfounded claims… Increased accountability will improve governance of the sector and management of natural resources.”

Sec. Dominguez mentioned that data transparency not only builds public trust but also brings institutional and sectoral resilience. Such resilience leads to better coordination, appropriate interventions and greater agility in times of crises.

Other speakers in the forum include Hon. Jose "Joey" Salceda who gave a Keynote Speech. He is the Representative of Second District of Albay and Chair of the House of Representatives Committee on Ways and Means.

“Key findings of the Seventh PH-EITI Report” was discussed by Hon. Bayani H. Agabin, who is the Undersecretary of Department of Finance and Chair of Philippine EITI.

“Industry Outlook” was reported by Hon. Ma. Teresa S. Habitan. She is the Assistant Secretary of Department of Finance and the Alternate Chair of Philippine EITI.

The Executive Director of Chamber of Mines of the Philippines, Atty Ronald Recidoro, reported “The Social Development and Management Program”.

“The National Wealth Shares Portal” was the topic of Mr Rainier H. Diaz, Chief Budget and Management Specialist of the Department of Budget.

“Mainstream Action Plan” was reported by Mr Vincent T. Lazatin, National Coordinator, Bantay Kita - Publish What You Pay Philippines.

“The PH-EITI work plan and progress of EITI implementation” was discussed by Eastwood D. Manlises, National Coordinator, Philippine EITI.

Finally, the closing remarks was delivered by Hon. Dakila Carlo Cua, Governor, Provincial Government of Quirino, and President, Union of Local Authorities of the Philippines.

The event was hosted by Triciah Terada.

Executive Summary and Overview of the 7th PH-EITI Report

The Seventh PH-EITI Report covers data from fiscal year 2019 and the early part of 2020. The goals of the report are the following:

1. Show direct and indirect contribution of extractives to the economy (through EITI process);

2. Improve public understanding of the management of natural resources and availability of data;

3. Strengthen national resource management / strengthen government systems;

4. Create opportunities for dialogue and constructive engagement in natural resource management in order to build trust and reduce conflict among stakeholders; and

5. Pursue and strengthen the extractive sector’s contribution to sustainable development.

As an outlook, the Philippines started to implement the EITI for eight years from its membership. Of note, the Philippines was the first to successfully obtain a Satisfactory Progress assessment in 2017. Since 2013, the PH-EITI has been publishing reports yearly. [2]

From their outlook report, they mentioned that 2019 is a notable for the Mining and Quarrying (MAQ) Industry for two reasons.

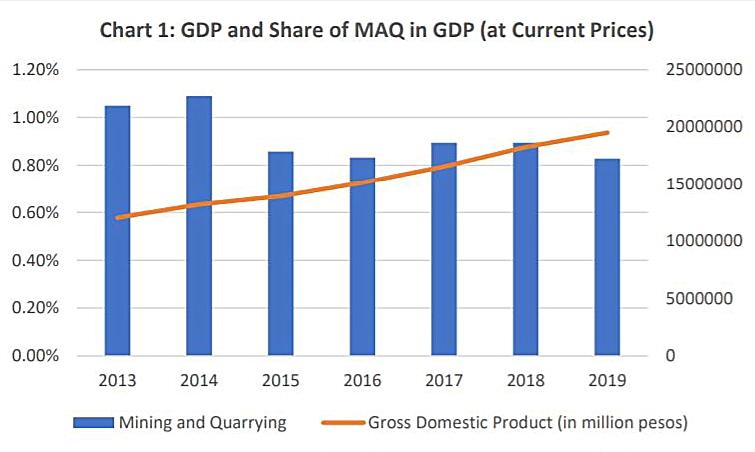

1. The industry’s share in Gross Domestic Product (GDP) decreased by PHP1.7 billion to 0.83% due largely to several mines closing. This was despite the fact that the Philippines’ GDP increased by PHP1.3 trillion.

Analysis: As presented in Chart 1 in line with the rest of the data from the Philippines Statistics Authority (PSA), the average annual growth rate (AAGR) of the country’s GDP from 2013 was 8.4%, and it was consistently increasing every year with 2018 being the highest at 10%. Even so, year-on-year (YOY) growth in MAQ was fluctuating; falling in 2015 to -17%, and eventually peaking in 2017 at 18%. Much of the reason for this fluctuation is the stifling regulation of the extractive industry. As a matter of fact, the substantial drop after 2014 was attributable to “The Philippine Mining Act of 1995 which stipulates that the state owns all mineral resources on public and private lands within the territory and exclusive economic zones of the country. In effect, the act regulated the Philippines’ mineral resource development eventually deliberalizing it. [3]

2. The second reason is due to the sudden surge of COVID-19 which affected the industry. This was first identified in Wuhan, China in the latter part of 2019. At first, the new disease was not previously seen as a global threat. It was only the following year when the global health emergency began. In the Philippines, the disease led to the implementation of official lockdown in most parts of the country on 17 March 2020.

More on the Extractive Industry

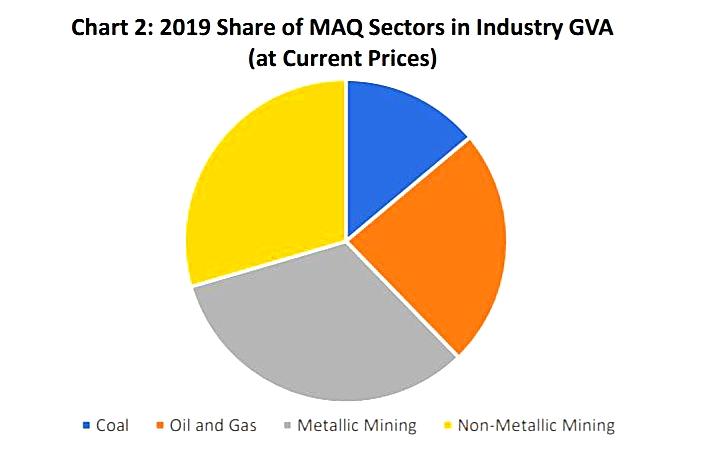

The first chapter of the Seventh Report detailed the top contributors of the extractive industry by region. Its total value addition in 2019 was PHP162 billion. As per Chart 2 with raw values from Philippine Statistics Authority (PSA), the mining sector had the highest gross share, making up almost two-thirds of it. This was followed by oil and gas at 24%, and coal at 14%.

Mining and Quarrying (MAQ) companies contributed much in the nation’s employment rate. They have around 210,961 workers in July 2019.[3]

The report also pointed out that mineral products and non-metallic mineral manufactures comprised 6.6% of total exported commodities which were valued at USD4.9 million. “As far as government revenues from these sectors were concerned, it is worth reiterating that it contributed more than a quarter billion PHP in the form of national and local taxes, fees, and royalties.”

According to Mines and Geosciences Bureau (MGB), there were 50 metallic mines in operation; 10 of which extracted gold, 3 copper, 31 nickel, 3 chromite, and 3 iron. And as per PSA, metallic mining had the biggest contribution to Gross Value Added (GVA) of the MAQ industry at 35%. It also had the greatest gross share in the production value of mining at a little less than 67%.

The Philippines, therefore, has more metals in its production of these commodities.

As for Non-metallic mining, there were more in operation in the same period at 53, 28 are limestone/shale quarries, 3 marble/marblelized limestone, 2 silica, 13 aggregate, 1 dolomite, 3 clay, 1 sand and gravel, 1 volcanic tuff, and 1 greywacke/pozzolan. “With respect to its share in MAQ’s GVA, it stood at a little more than 31%. As a proportion of the mining sector’s volume of gross production, non-metallic mining’s was 33% which, in absolute terms, was almost half of that of metallic mines.”[3]

For oil and gas, covering the fiscal year 2019, Department of Energy (DOE) reported the oil production in the Philippines was all sourced from Galoc, Nido, Matinloc, and Alegria. The report stated that Galoc was the most prolific among the others, comprising 96% of the total extracted at 744,449 barrels. Nido was second at 20,634; then Alegria at 9,468; and Matinloc at 1,542.

According to the report, “…the output from the Malampaya field was not as significant in comparison with these oil fields. Conforming to PH-EITI37, the petroleum service contract operators that voluntarily report to the organization are The Philodrill Corporation, Galoc Production Company WLL, the state-owned PNOC Exploration Corporation (PNOC-EC) of the Philippine National Oil Company (PNOC), Shell Philippines Exploration B.V. (SPEX), and China International Mining Petroleum Company Ltd.”

(to be continued)

-----

Reference:

[1] https://pheiti.dof.gov.ph/natcon2021/

[2] https://pheiti.dof.gov.ph/download/7th-report-contextual-info-chapter/?wpdmdl=2439

[3] https://pheiti.dof.gov.ph/download/7th-report-industry-outlook-chapter-2/?wpdmdl=2440