“Although there is a seen decrease in the bilateral trade between Germany and the Philippines when comparing the first half of 2022 and 2021 data, it remains to be a major contributor to the latter's trade relations with the EU.” (from GPCCI Market Watch)

A quick look at the future:

- The Philippines is expected to join the free trade agreement -- Comprehensive and Progressive Agreement for Trans-Pacific Partnership. This would benefit the Philippine metals industry.

- The German Supply Chain Due Diligence Act will have a significant impact on business practices across the Asia-Pacific (including the Philippines, which lists Germany as its 10th largest export trading partner).

Looking at the numbers, the economic outlook of 2022 looks bright. According to a report presented by German-Philippine Chamber of Commerce and Industry (GPCCI), the Philippine gross domestic products (GDP) showed favourable development and promising growth during the first half of 2022. From their report on "GPCCI Market Watch: Philippines Shows Promise in the 1st Half of 2022", the Philippine GDP grew more than expected due to high public spending, relaxed COVID-19 mobility restrictions, and a rebound in investments and household consumption. Due to these factors, the Asian Development Bank (ADB) raised its growth outlook for 2022 from 6.0% to 6.5%, halfway through the year. [1]

During the second quarter, the GDP growth decreased to 7.4% due to global headwinds like geopolitical tensions and inflation. This is lower than 8.3% growth during the first quarter. Banko Sentral ng Pilipinas (BSP) also forecasted that inflation rate of 5.4% and raised key interest rates to 4.0% from an initial 2.0%. Afterwards, the Development Budget Coordination Committee (DBCC) revised their full-year 2022 growth forecast to 6.5% to 7.5%.

“Despite the slowdown of the second quarter growth, it is notable that the Philippines still had the 2nd highest GDP growth recorded for the second quarter in the ASEAN region. For the first half of 2022 overall, the Philippines’ GDP grew by 7.8% - the highest among the five biggest economies in ASEAN. The Philippine Central Bank stated that domestic economic activity is seen to be restored to its pre-pandemic level in the second half of 2022,” according to GPCCI.

Several changes in 2022 took place which gradually contributed to mobility in most sectors. “As the country continues its efforts in the transition to the new normal, the Department of Education implemented mandatory face-to-face classes for the school year of 2022-2023. Aside from this, the mandatory wearing of face masks outdoors was also lifted. It was imposed for more than two years to contain the spread of the coronavirus in the country.”

“According to experts, the outlook of the country’s economy remains positive. The materialization of the initiated economic reforms and the continuation of key programs such as the infrastructure expansion by the new administration shall support the robust economic development for the 2nd half of the year and beyond.”

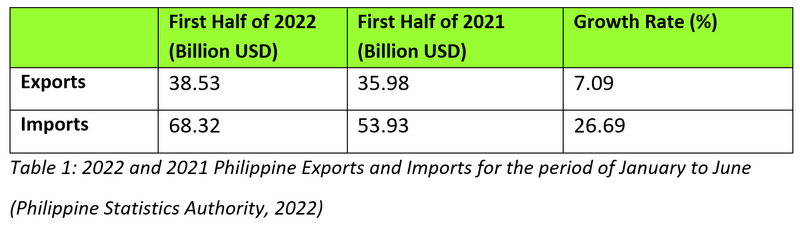

Looking at the Philippine international trade activities for the first half of 2022, both exports and imports increased year-on-year with a growth rate of 7.09% and 26.69% respectively. “Imports grew much faster than exports by a significant margin with the Philippine trade deficit increasing by USD 11.84 billion as a result of this.” [1]

The Philippine Statistics Authority reported that June 2022 marked the 17th straight month of import growth.

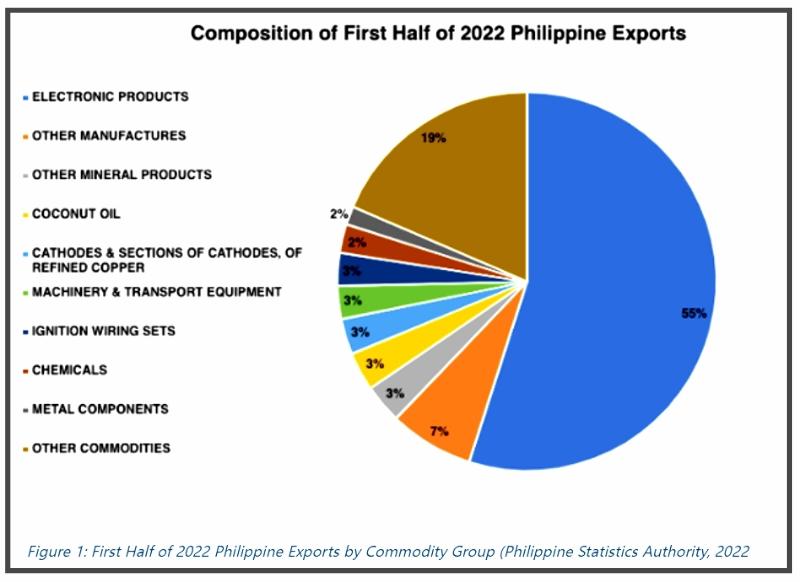

The export and import activities in 2022 include significant movement in the minerals industry. “Philippine exports are mainly composed of electronic products accounting for 55% of the total exports or USD 21.16 billion for the first half of the year. Other commodity groups that widely contribute to the exports of the country are (1) other manufacturers with 7%, (2) cathodes and sections of cathodes, refined copper with 3%, (3) coconut oil with 3% as well.”

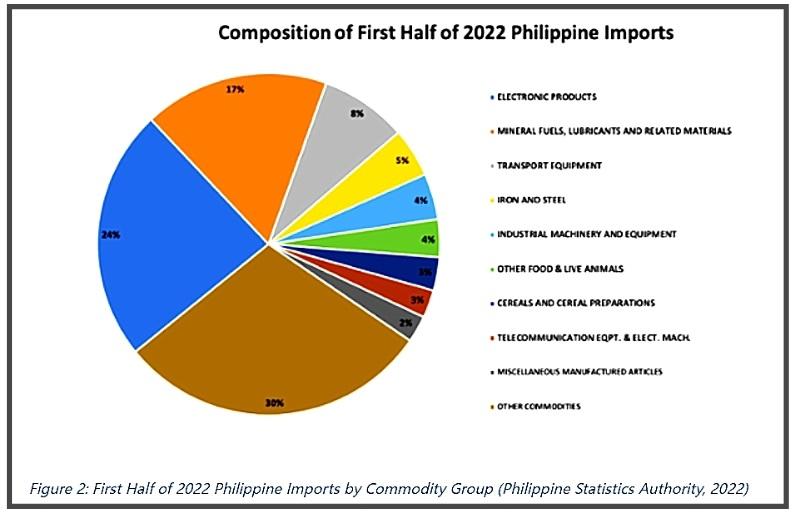

On the list of imported individual commodities, Electronic Products were also on the top of the list, comprising 24% of all imports or USD 16.3 billion in total. Minerals, Fuels, Lubricants and related materials, Transport Equipment, Iron and Steel had shares of 17%, 8%, and 5% respectively, according to the Philippine Statistics Authority.

For both exportation and importation, the top 10 trading partners of the Philippines include the neighboring countries of the Philippines in Asia. “In terms of its export partners, the United States and European Union (EU) countries such as German and the Netherlands have been its non-Asia partners that belong to the top rank. While for its import partners, the United States is the only non-Asia country that belongs to the list.”

More on the non-Asia trade partners of the Philippines, for the first half of 2022, the United States of America ranks as No. 1 in the list of international trade partners for Exports, with USD 5.94 billion. Netherlands is on rank No. 7 with USD 1.45 billion, while Germany is on rank No. 10 with USD 1.31 billion. For Imports, United States of America is on rank No. 5, with USD 4.40 billion.

“Although there is a seen decrease in the bilateral trade between Germany and the Philippines when comparing the first half of 2022 and 2021 data, it remains to be a major contributor to the latter's trade relations with the EU. Exports of the Philippines to Germany, decreased by 8.46% as the previous USD 1.42 billion in 2021 went down to USD 1.30 billion in 2022. Similarly, imports declined by 9.15%, when the USD 1.06 billion in 2021 was cut to USD 960 million in 2022.” [1]

On a final note, what are we to expect in the future in terms of economic growth? GPCCI Market Watch listed down some trends and factors that can affect economic growth in the future. Here are the trends to look out for:

1) Global Inflation: The International Monetary Fund (IMF) recently gave out unfavorable projections for the global economy in its recent report with inflation in advanced and developing economies projected to reach 6.6% and 9.5% respectively. As seen in the Philippines, the country experienced a 6.4% inflation rate in July of this year (the highest recorded inflation rate in 4 years) due to a rise in commodity prices. Experts also believe this rise in inflation will peak in the 4th quarter of 2022. Consequently, analysts say this bleak outlook on inflation for the rest of the year may lead to the Philippine Central Bank raising the key interest rate to 4.25% by the end of 2022.

2) CPTPP: The Comprehensive and Progressive Agreement for Trans-Pacific Partnership or CPTPP is a free trade agreement currently comprised of 11 countries, Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore, and Vietnam. The Philippines, along with Thailand and South Korea, is expected to join the agreement within the next few years with Chile supporting their potential accession. By joining this free trade agreement, various sectors in the country such as electronic equipment, apparel, machinery, and metals would benefit.

3) Supply Chain Due Diligence Act: By the start of 2023, the German Supply Chain Due Diligence Act will come into force. Initially approved in 2021, the act aims to ensure that German businesses with more than 3000 employees will have no links in their supply chains that violate human rights or environmental laws. And by 2024, the size requirement will drop to 1000 employees. Hence, companies that wish to enter the German market or work with large German companies will need to have humane and stable business practices. Experts say this new legislation will have a significant impact on business practices across the Asia Pacific; including the Philippines, which lists Germany as its 10th largest export trading partner. Also, the EU is currently in the process of creating the EU Due Diligence Act, which aims to apply similar supply chain standards for companies across all EU member states and beyond. [1]

-----

Reference:

[1] Ramos, Nicole (4 October 2022). GPCCI Market Watch: Philippines Shows Promise in 1st Half of 2022.

Acknowledgment:

Thank you to Ms Nicole Ramos, Senior Consultant at German-Philippine Chamber of Commerce and Industry.

German-Philippine Chamber of Commerce and Industry (GPCCI)

8F Doehle Haus Manila 30-38 Sen. Gil Puyat Avenue, Brgy. San Isidro, Makati City Philippines, 1234

Telephone: +63 (2) 8519 8110 / Telefax: +63 (2) 5310 3656

Website: https://philippinen.ahk.de/en/

-----

Top photo: geralt / 25234 images - https://pixabay.com/illustrations/businessman-charts-trend-tablet-5669431/