Amidst inflation, supply chain interruptions, geopolitical upheaval, the devastating effects of the COVID-19 pandemic, and their subsequent effects on the energy and industrial commodities markets, mining companies are facing enormous challenges in achieving their profitability and sustainability goals. Environmental, social, and governance (ESG) considerations are more critical than ever, with issues on sustainability gaining prominence and requiring implementation of decarbonization strategic planning. One key aspect of this strategy involves significant investments in renewable energy sources and comprehensive planning to bolster global supply stability in volatile times. Against this backdrop the Chamber of Mines of the Philippines (“COMP”) played host once again to the Mining Philippines Conference 2023 with the theme, “Seeing Green”.

COMP Chair Michael Toledo articulated that the Philippines can only take advantage of opportunities in the energy transition if two conditions were met. First, the country must be able to address the divided public opinion on mining. The second condition involves resolving other issues affecting the investment climate in the industry. These issues include conflicting local and national laws, high costs of power, a protracted permitting process, and a fiscal regime that will not only enhance our country’s competitiveness as a mining investment destination, but equally important, reflective of the government’s designation of mining from being merely a “beneficial” industry to one that is “essential” and “critical”.

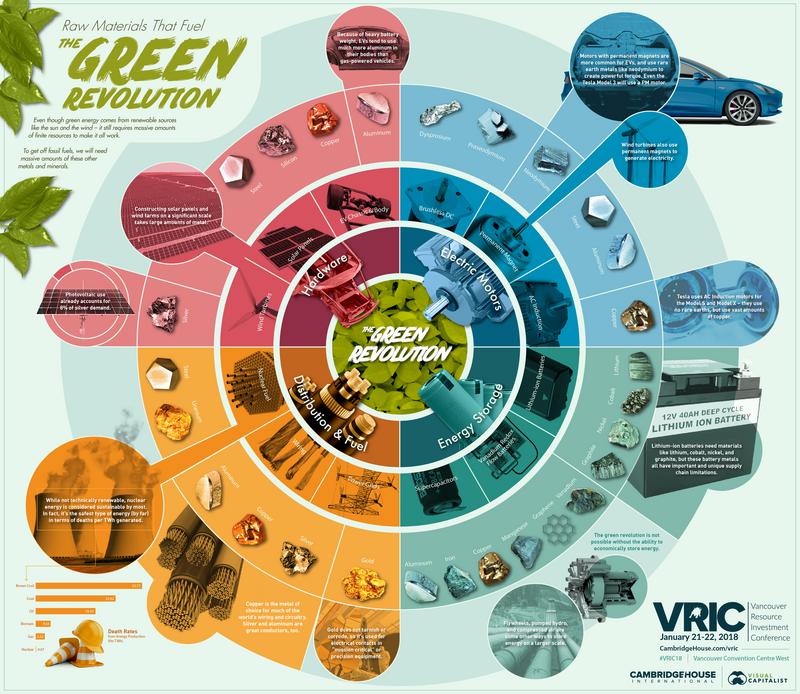

Assessing the Philippines' Potential in the Global Green Metals Revolution

According to the S&P Global Commodity Insights Report, the Philippines is more involved in the upstream industry. A few projects are currently in development, but potential additional value of ores is lost due to lack of local processing capacity. Only fourteen percent (14%) of current Mineral Production Sharing Agreements (“MPSA’) are nickel and copper projects under development.

Philippine exploration budgets dwindled in the recent decade and have not recovered since the imposition of the moratorium on new mining agreements and the ban on open pit mining. In 2022, exploration budget was only US$35 million, representing ten percent (10%) of exploration in the Pacific valued at US$330 million. There was more intensive exploration for green metals in 2022 but most allocations were still directed to exploration activities at mine sites. Local exploration remains gold-focused while advanced exploration for copper and nickel dominates.

The Philippines holds huge untapped and underdeveloped deposits of copper and nickel. The country, which hosts the world’s fourth largest nickel reserves, remains competitive while lagging in copper reserves compared to other countries. It also has the third longest average lead time from discovery to production - 19 years. It maintained its rank in nickel production but lag other countries in copper production.

Nickel and copper production is expected to increase in the medium term with the Philippines maintaining its second spot in 2022 next to Indonesia despite seven percent (7%) year-per-year decrease. The Philippines contributes less than one percent (1%) of global mined copper production in 2022 but there is strong projected growth for copper production when the Tampakan project goes on-stream.

Meanwhile, the Department of Environment and Natural Resources (“DENR”) reported that it is currently undertaking advanced exploration of proposed mineral reservation areas to look for possible local sources of rare earth elements and other critical minerals through its National Mineral Reservation Program. The DENR’s critical mineral policy aspires to provide a sustainable supply of critical minerals and establish value-adding downstream mineral processing industries. No discussion was made, however, as to the source of funding and technical expertise-building in the exploration of critical minerals.

If commodity demand and prices stand their ground, alongside a conducive policy environment and the elimination of physical infrastructure bottlenecks, a significant comeback might be on the horizon. More initiatives from the exploration side to the processing sector are needed to revitalize the Philippines’ position in the nickel and copper value chain. The mining industry’s objectives in expanding the mining and processing involvement of the Philippines must be balanced with the country’s decarbonization goals.

The DENR Continues to Focus on Sustainability and Climate Change Resilience

Globally, climate change has placed the net-zero agenda on top of the objectives of mining companies. At the mining conference, the DENR found it apt to remind the industry to tackle the tangible threats posed by climate change.

In DENR Secretary Maria Antonia Yulo-Loyzaga keynote speech, she mentioned that her department has pilot-tested a new process called Negotiated Sustainability and Resilience Agreement for implementation in 2024. This process involves a dialogue between the DENR and the mining companies to identify and negotiate shared goals such as reduced environmental impacts, renewable energy adoption, and community resilience for the overall improvement of their quality of life.

The DENR also revised the Social Development Management Program under the Philippine Mining Act of 1995 to link it to the Sustainable Development Goals adopted by United Nations member states, to build in the assurance that mining operations respond to host community and ecosystems needs. Secondly, the DENR hopes to formalize small scale miners through step-wise, alternative arrangements to regard them as partners and members of the mining sector. One of these is a proposal to register small scale miners individually, followed by the establishment of a loose organization as the foundation for a more formal association or cooperative towards Minahang Bayan registration. Thirdly, the DENR has adopted the Mitigation Hierarchy in evaluating proposed and ongoing developments in the mining sector. Finally, the DENR reported that it is investing in the digitization of all mining-related information and the processing of applications and permits. Digitization should address making DENR’s procedures more efficient, leading to shorter and more transparent processing permits and applications.

Rationalization of the Mining Fiscal Regime and Developing a Mining Roadmap

With inflation creeping upward, mining companies are pushed to keep cost fluctuation at bay and maximize profits. While investors are pursuing their capital allocation strategies, they are on the lookout not only for mineral prospectivity but on the host country’s tax regime as well. The conference was a venue for the Philippine government to present its new package of fiscal regimes vis a vis other mining jurisdiction.

The Department of Finance (“DOF”) presented that the current mining fiscal regime is heavily geared towards taxation based on gross revenue but does not have a component to capture windfall profits. In contrast, taxes of other countries are skewed towards profitability. The DOF enumerated key reforms under its proposed mining fiscal regime:

- Simplification of the mining fiscal regime from the current five to two;

- Imposition of three percent (3%) royalty tax outside mineral reservation to address the constitutional issue;

- Introduction of a windfall profit tax mechanism to ensure government’s fair share when mineral prices are high; and

- Provisions on thin-capitalization, ring-fencing, transparency, and accountability.

The proposed special mining tax will be based on “margin”, ranging from zero percent (0%) to fifteen percent (15%). The windfall profit tax is proposed to be not deductible from corporate income tax.

Meanwhile Department of Trade and Industry (“DTI”) Secretary Alfredo E. Pascual in his keynote speech, said the DTI is firmly pushing for the development of the green metals sector by advocating for value-added downstream mineral activities in the segment of battery precursor production used for electric vehicles batteries and battery energy storage system. This initiative is anchored on the global transition to clean energy technologies, which calls for the promotion and development of green metals.

The DTI-Board of Investments also leads the Working Group on Mineral Processing and Battery Manufacturing/Green Metals, which seeks to address concerns and issues vital for developing and promoting the sector to create a strategy that will attract mineral processors and battery manufacturers into the country. As the Philippines aims to strategically position itself in the regional and global value chains of electric vehicles and batteries, it is essential for the government to recognize the suitability of local nickel ores for battery applications particularly battery-grade materials for cathodes. Moreover, Secretary Pascual believes that the abundance of other mineral resources like copper plays a pivotal role in providing essential components of electric vehicles.

Secretary Pascual added that government policy must focus on advancing value-added activities and increasing participation in the regional and global value chains of electric vehicles, batteries, and renewable energy equipment. He mentioned that there is a tremendous opportunity to use the extractive industry's potential to propel long-term economic growth. He identified several opportunities in mining and mineral processing which include:

- Green metals processing (cobalt, copper, nickel) and other value-added downstream mineral activities;

- Copper wire rod facility (to address the value chain gap in the local copper industry);

- Battery technologies; and

- End-user industries like renewable energy equipment.

As an added attraction in doing business in the Philippines, Secretary Pascual also mentioned that Section 300 of the Corporate Recovery and Tax Incentives for Enterprises (“CREATE”) Act, provides for the formulation of the Strategic Investment Priority Plan (“SIPP”). Signed on 24 May 2022, the SIPP is the country's investment plan containing the list of priority activities for investment promotion and facilitation supported through fiscal and non-fiscal incentives as provided in the CREATE Act.

The exploration of metallic resources is listed under Tier 1 (Special Laws) which is limited only to capital equipment incentives. On the other hand, green metals processing is listed under Tier 2, where activities cover environment, health, food security, industrial value-chain, and defense-related activities. The SIPP guarantees higher incentives, Tier 2, for registered business enterprises located farther from metropolitan areas and the highest incentives under Tier 3, where projects or activities involve research and development applications, and highly advanced technologies.

Mining Fiscal Regimes and Benchmarking

To realize the revenue potential of the local mining industry and strengthen its international competitiveness, the United States Department of Interior and Department of State provided policy support and technical assistance to the DENR in designing and implementing an upstream fiscal regime. The Technical Assistance on Mining Sector Governance for the Government of the Philippines came out with a report prepared by Deloitte outlining its Key Observations on Philippine mining income taxation. The report presented during the conference stated that income tax rate is comparable to that in benchmarked nations as well as accelerated depreciation. However, the period to carry forward a loss is more restrictive in the Philippines than in the benchmarked nations. Also, special deductions and credits to encourage mining are not offered or are discretionary unlike some benchmarked nations where they are generally automatic and not subject to discretionary approval.

It was recommended in the report that the Philippine government continue to apply the same income tax rates to mines that apply to other taxpayers. In addition, the report recommended not to provide a depletion allowance, like other nations with state-owned minerals, and amend Section 34(G) of National Internal Revenue Code of 1997 (“NIRC”) accordingly and consider not granting income tax holidays to mining taxpayers. This recommendation also calls for an update of Section 83 of the Mining Act, and Sections 39, 217, and 227 of its implementing rules and regulations.

On royalty and excise taxes, the Philippines, unlike most nations, imposes both royalty and excise taxes which total to twelve percent (12%), broken down as follows:

- 5% Royalty Tax - only levied in a mineral reserve area;

- 4% Excise Tax - no benchmarked nation charged excise tax on mineral sale;

- 2% Local Government Tax (maximum); and

- 1% Royalty Tax to Indigenous People (minimum).

The report mentioned that royalty rates exceed those in benchmarked nations and the combined rate is one of the highest in the world. The current approach imposes a high combined ad-valorem royalty. It recommended that the Philippine government consider imposing a single royalty and subjecting all mines to a five to fourteen percent (5-14%) sliding scale royalty based on net operating ratio applied to net income, like the royalty system in Chile.

To summarize, the key recommendations for reform in the report called for the Philippine government to consider discontinuing royalty imposed on mines within a mineral reservation and zero-rate mineral sales for excise tax. Instead, a new tax based on the Chilean approach of an operating margin-based royalty can be imposed.

A new royalty approach could include the existing one percent (1%) royalty on mines in ancestral lands, existing two percent (2%) local business tax, and a new sliding scale operating margin-based royalty. The benefits of a sliding scale operating-margin (annual profitability) royalty are as follows:

- Progressive (higher profit mines are taxed more heavily than lower profit mines);

- More marginal operations can be built, enhancing tax base potential;

- Automatic adjustments for price cycles (allows the government to capture additional revenue when commodity prices are high without placing a large economic burden on mining companies when prices are low); and

- Well-tested in major mining nations like Chile and Peru.

It was also recommended that the Philippine government consider adopting non-discretionary exemptions, deductions, and discontinuing the current system where investors must still apply for various fiscal incentives. The discretionary SIPP approach doesn’t suit mining based on the following reasons:

- Deductions/exemptions/incentives are unstable, unpredictable, ad hoc, and discretionary;

- The SIPP is revised every 3 years;

- The tax approach can be standardized in the NIRC, eliminating the need for SIPP; and

- Investors consider predictability and consistency in fiscal regimes to be of high importance when evaluating where to invest.

Finally, it was recommended that the Philippine government consider making the fiscal systems for Financial or Technical Assistance Agreements (“FTAA”) and Mineral Production Sharing Agreement (“MPSA”) identical. The current approach imposes different fiscal systems on FTAAs and MPSAs. The FTAA approach includes an Additional Government Share that is not conducive to attracting investors. A single system would be administratively easier to regulate and monitor. The unified system can also facilitate the standardization of tax matters set out in the NIRC, negating the need to include these provisions in the MPSA and FTAA contracts, resulting in simpler agreements.

A fiscal regime combining a royalty and tax targeted explicitly on rents (along with the standard corporate income tax) has appeal for many developing countries including the Philippines. Such a regime ensures that some revenue arises from the start of production, and that the government’s revenue rises as rents increase with higher commodity prices or lower costs. In so doing, it can also enhance the stability and credibility of the fiscal regime (though processes to allow renegotiation may also be needed). It can also balance the challenges that each instrument poses for administration. Transparent rules and contracts tend to improve stability and credibility. Poorly designed international tax arrangements, however, can seriously undermine revenue potential.

Continuing the Engagement Between the Government and the Industry

ESG considerations are the driving force for enhanced transparencies in mining operations with calls for urgent compliance by mining companies for greater diversity, equity, and inclusion, as well as responsible mine closure strategies. This has resulted in stronger ties and coordination with host governments and fostering more stakeholder collaboration.

In his Keynote Speech, Manuel V. Pangilinan, Philex Mining Corporation Chair, suggested that the private sector should help government raise its supervisory capabilities through funding of scholarships and training, procurement of equipment, and hiring of requisite personnel. He also called for the separation of the functions of regulation and the promotion of the mining industry. The Mines and Geosciences Bureau (“MGB”) is charged with the promotion, development, and supervision of mining. The Environmental Management Bureau’s (“EMB”) mandate on the other hand, is to enforce environmental laws on mining. Both fall under the supervision of the DENR. These apparently conflicting goals can, at times, place the DENR in a policy dilemma. He suggested spinning off the EMB into a separate and independent body, like the Environmental Protection Agency in the US.

Mr. Pangilinan said that Philex is open to a profit-based fiscal regime to assure the government that an appropriate share of the benefits derived from the resources the state owns. It welcomes the recent congressional approval on second reading of House Bill No. 8937, which proposed a royalty rate calculated against margins realized by mining companies, as well as a windfall profits tax.

Finally, Mr. Pangilinan believes that the mining benefits between the host local government units (“LGU”) and the national government should be shared more equitably. The national government must ensure the timely remittance of taxes due LGUs. As mining is location specific, Philex sympathizes with the LGUs’ desire to realize the fruits of the resources situated in their communities.

Philex is optimistic because the Marcos administration has been clear, predictable, and transparent with respect to mining and applauds the President’s desire to expand the industry, spread the benefits of mining to the countryside, and incentivize the processing of ores into higher value-added export products.

I share Mr. Pangilinan’s sentiments in providing technical assistance to monitoring agencies to build capacity in government regulatory offices. In my capacity as Chair of the Professional Regulatory Board of Geology, I have been recommending mining and energy companies to sponsor scholarships for government employees and local academics in my inspection and monitoring of these establishments. Also, just like Mr. Pangilinan, I have been critical of the administrative set-up of the DENR, having both the MGB and EMB under its wings. However, I have advocated in my previous commentaries that the MGB be removed from the administrative control of the DENR.

With a sold-out attendance, the conference was indeed a success in whetting the appetite of the business community craving a positive outlook for the local mining industry. But quoting Johann Wolfgang Goethe: “The greatest thing in this world is not so much where we stand as in what direction we are moving.” I hope that this level of engagement is soon translated to real action. I see the outcome of the conference as an opportunity for the industry to enhance its reputation, gain greater recognition for the economic benefits mining has bestowed, and pledge commitment to deliver its objective of promoting sustainability.

Fernando “Ronnie” S. Penarroyo specializes in Energy and Resources Law, Project Finance and Business Development. He is also currently the Chair of the Professional Regulatory Board of Geology; the government agency mandated under law to regulate and develop the geology profession. He may be contacted at fspenarroyo@penpalaw.com for any matters or inquiries in relation to the Philippine resources industry and suggested topics for commentaries. Atty. Penarroyo’s commentaries are also archived at his professional blogsite at www.penarroyo.com

Copies of the Mining Philippines 2023 conference presentations are available for reference at: https://app.glueup.com/event/mining-philippines-international-conference-and-exhibition-81637/