Celsius Resources Ltd. has reported fresh high-grade copper and gold intercepts from its ongoing drilling program at the MCB Copper-Gold Project in the Kalinga province, strengthening confidence in the project’s potential ahead of its updated feasibility study.

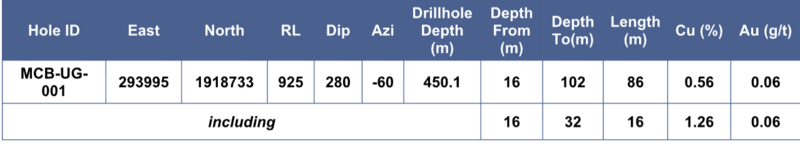

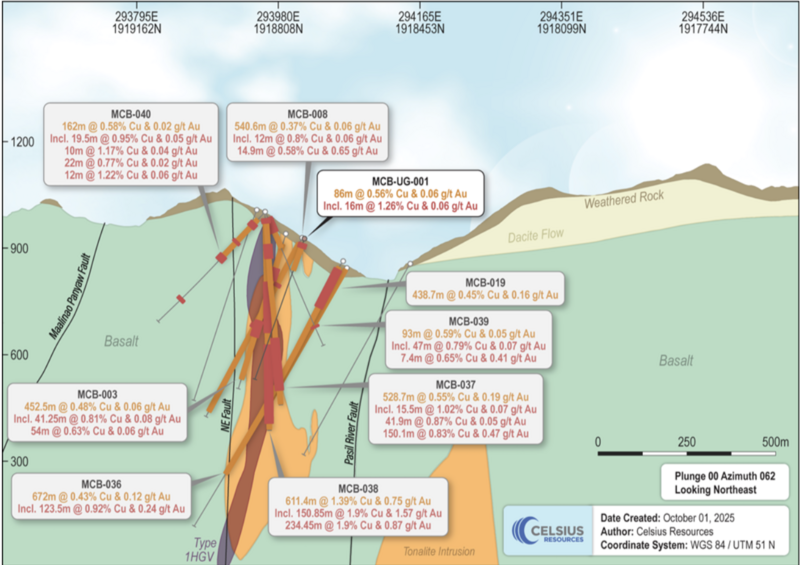

In a disclosure to the Australian Securities Exchange (ASX) and the London-based Alternative Investment Market (AIM), Celsius said its latest drill hole intersected 86 meters at 0.56 percent copper and 0.06 grams per tonne (g/t) gold from a depth of 16 meters, including 16 meters at 1.26 percent copper and 0.06 g/t gold within that zone.

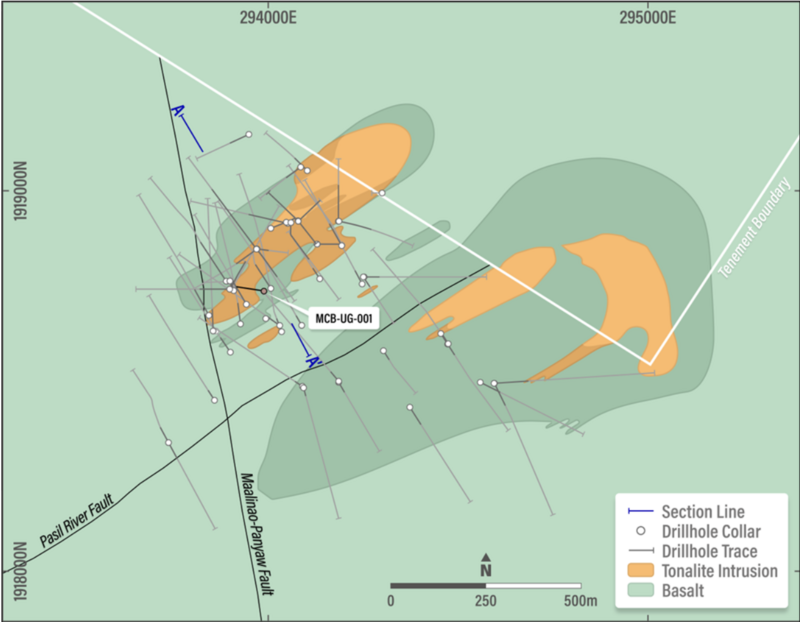

The drilling program, conducted through its Philippine subsidiary Makilala Mining Co. Inc. (MMCI), began in June and is aimed at collecting geotechnical and hydrological data as well as samples for metallurgical testing.

“This recent drill hole was completed to provide additional mine design and geo-technical data,” said Makilala Mining Technical Director Peter Hume. “With these new higher-grade intercepts, the board has further confidence that the final mine plan will deliver the best value for the MCB Project, our investors, shareholders and the community.”

According to the company, assay results have so far covered only the upper 102 meters of the 450.1-meter-deep drill hole. The remaining results are still pending and will be released once validated. The early data, Celsius said, confirms consistent high-grade mineralization in the targeted zone.

Feasibility study 60% complete

Celsius said its updated feasibility study is now more than 60 percent complete, with work on the mine design and 3D plant layout nearing completion. Once all drill results are received, the company expects to release an updated Mineral Resource Estimate (MRE) and a JORC-compliant Ore Reserve Statement alongside the revised feasibility study by December 2025.

proximity to historical diamond drilling, highlighting significant assay results (looking northeast).

Background on the MCB Project

The MCB Copper-Gold Project, located about 320 kilometers north of Manila, is the flagship asset in Celsius’ Makilala portfolio. An updated mineral resource estimate released in December 2022 reported 338 million tonnes grading 0.47 percent copper and 0.12 g/t gold, equivalent to 1.6 million tonnes of contained copper and 1.3 million ounces of gold.

A previous study released in December 2021 outlined the potential for a 25-year underground mining operation producing copper-gold concentrate. It projected a post-tax net present value (NPV) of US$464 million and an internal rate of return (IRR) of 31 percent, based on copper at US$4.00 per pound and gold at US$1,695 per ounce.

The operation was designed around a 2.28 million tonnes per annum (Mtpa) processing plant, with an estimated initial capital expenditure of US$253 million and a payback period of about 2.7 years.

Celsius said the ongoing feasibility work, along with front-end engineering and design (FEED) studies, remains on track for completion before the end of the year.